- LOGIN

- MemberShip

- 2026-03-10 07:55:18

- Policy

- DPK moves to hold Welfare Committee plenary session unilaterally

- by Lee, Jeong-Hwan Feb 26, 2026 07:47am

- The Democratic Party of Korea has decided to convene a plenary session of the National Assembly's Health and Welfare Committee on the 26th, solely with its own members, to receive a report from the Ministry of Health and Welfare on current issues, including medical school enrollment expansion and regional, essential, and public healthcare policies.This move comes in response to the main opposition party, the People Power Party, conducting a filibuster (unlimited debate) and deciding to boycott all standing committee proceedings, citing the Democratic Party's unilateral handling of the plenary session agenda.Notably, some Democratic Party members of the committee have also raised the need to review and pass bills assigned to the first Subcommittee of the Legislation and Judiciary Committee during the plenary session.However, such a move is expected to trigger significant friction with the People Power Party over future standing committee operations and bill deliberations.According to a Democratic Party official on the 25th, the Health and Welfare Committee (Chair Jumin Park) has tentatively decided to hold a plenary session on the afternoon of the 26th. During the session, the Ministry of Health and Welfare will present reports on key pending issues, including medical school quota expansion, emergency medical care, and the regional physician initiative, and adopt the plan for a public hearing on the Patient Basic Act bill.The second Subcommittee of the Legislation and Judiciary Committee will convene as scheduled at 10 a.m. on the 27th.This decision to proceed with the Welfare Committee plenary session and the second Subcommittee of the Legislation and Judiciary Committee's meeting was made solely by the Democratic Party, without involvement from the People Power Party.It is reported that the decision to hold the plenary session solely by the Democratic Party came after the first Subcommittee of the Legislation and Judiciary Committee meeting, originally scheduled for the 26th, could not be held due to a boycott by the People Power Party.A key point of attention is whether the Democratic Party will attempt to deliberate and pass bills assigned to the first Subcommittee of the Legislation and Judiciary Committee during the plenary session.This necessity arose because some ruling party welfare committee members have strongly criticized the fact that the subcommittee has not convened for several months and argued that it may now be necessary to process pending legislation at the plenary level.The problem is that if the Democratic Party reviews and votes on bills under the jurisdiction of the first subcommittee at the plenary session without the opposition parties, including the People Power Party, the Welfare Committee could face disruptions in its normal operations due to clashes between the ruling and opposition parties.A Democratic Party welfare committee official hinted, “Due to the opposition party's lack of cooperation, bill subcommittee meetings failed to take place in December and January, and there is now a risk that February will follow the same pattern. There are strong voices from some lawmakers stating the necessity to review past livelihood-related bills during the plenary session.”

- Policy

- Expanded reimb for Imfinzi will be available next month

- by Jung, Heung-Jun Feb 25, 2026 05:46pm

- AstraZeneca Korea's Imfinzi New reimbursement criteria for anticancer drugs will be established ahead of the expanded insurance coverage for AstraZeneca Korea's Imfinzi (durvalumab), an immunotherapy used to treat cancer.Starting in March, Imfinzi combination therapy will be added for both liver cancer and biliary tract cancer. Notably, in liver cancer, the drug achieved dual success by simultaneously proving its combination therapy with Imjudo (tremelimumab).On the 23rd, the Health Insurance Review and Assessment Service (HIRA) announced that it is currently conducting an opinion survey regarding the revision of the "Application criteria for National Health Insurance reimbursement for drugs prescribed and administered to cancer patients." After the survey ends on the 25th, the revised contents will be applied starting in March.For liver cancer, the combination therapy with Imjudo will be newly established. Reimbursement is limited to patients with advanced hepatocellular carcinoma who are ineligible for surgery or local treatment and who meet specific criteria.The reimbursement criteria are appliable up to 1 year of treatment. However, if clinical results for the administration period within that year have not been published, reimbursement will be automatically extended for up to 2 years.For biliary tract cancer, the combination therapy of Imfinzi (durvalumab) + gemcitabine + cisplatin will be newly established. Insurance coverage will apply to patients with unresectable locally advanced or metastatic biliary tract cancer. This is limited to adenocarcinoma and excludes ampullary Vater carcinoma.Gemcitabine and cisplatin will not be administered after the initial 8 cycles of combination therapy. The reimbursement period is the same as that for the liver cancer combination therapy.Imfinzi is becoming reimbursed for two combination therapies. Consequently, Imfinzi prescriptions, which had been concentrated on lung cancer, are expected to expand into liver cancer and biliary tract cancer.In particular, it will emerge as a new treatment option for biliary tract cancer. Imfinzi is the second drug to receive a flexible Incremental Cost-Effectiveness Ratio (ICER) for an innovative new drug.In this revision, Janssen Korea's Balversa (erdafitinib) monotherapy for urothelial carcinoma was also newly established. It is indicated for second-line or later use, and the target population is "patients with unresectable locally advanced or metastatic urothelial carcinoma with FGFR3 genetic alterations whose disease has progressed during or following at least one prior systemic therapy, including a PD-1 or PD-L1 inhibitor."For multiple myeloma, a second-line or later combination therapy of Antengene's Xpovio (selinexor) + bortezomib + dexamethasone was newly established. It can be administered to patients with multiple myeloma who have failed previous treatments.Xpovio received a decision on reimbursement expansion conditions from the Drug Benefit Evaluation Committee meeting last November, which required the company to accept a price below the evaluated amount.

- Policy

- GC Biopharma expands lineup to target antihistamine market

- by Jung, Heung-Jun Feb 25, 2026 05:45pm

- GC Biopharma is expanding its reimbursed lineup of its fexofenadine-based Neofexo Tablets this year to strengthen its position in the prescription market for allergic rhinitis.By increasing the number of reimbursed items, it is entering the antihistamine prescription market as a latecomer, where companies like Handok, Hanmi, and Yuyu are competing.According to industry sources on the 24th, following the listing of Neofexo Tab 120mg (fexofenadine hydrochloride) in January, GC Biopharma will add Neofexo Tab 180mg to the reimbursement list in March.GC Biopharma plans to list Neofexo Tab 180mg for reimbursement in March. AI-generated image.The reimbursement ceiling price for Neofexo Tab 180mg has been set at KRW 267. Neofexo Tab 120mg, listed in January, previously received a ceiling price of KRW 220.Fexofenadine, a third-generation antihistamine, is marketed as both an over-the-counter (OTC) and prescription drug. The 120mg formulation is available in both categories, while the 180mg strength is prescribed exclusively.OTC formulations are indicated solely for the relief of seasonal allergic rhinitis, whereas prescription products carry broader indications, including symptom relief in chronic idiopathic urticaria.Neofexo Tab 120mg was approved as an OTC product, while the newly listed Neofexo Tab 180mg can only be sold as a prescription drug.A review of previously reimbursed products shows that companies including Handok, Hanmi Pharm, Yuyu Pharma, Chong Kun Dang, Il-Yang Pharm, and Hutecs Korea are actively competing in the prescription segment.Meanwhile, Allegra Tab, the original fexofenadine product, continues to demonstrate steady sales growth. According to UBIST, Allegra recorded sales of KRW 7.9 billion last year, marking a 9% increase year-on-year. Hanmi Pharm’s Fexonadine Tab also posted modest growth, rising 2% to KRW 3.3 billion.GC Biopharma already markets Allerjet Soft Cap, a 60mg OTC fexofenadine hydrochloride product approved in 2023.With reimbursement coverage now for Neofexo Tab, the company is expected to accelerate its strategic push into the allergic rhinitis market.

- Policy

- MFDS offering regulatory support for orphan drug discovery

- by Lee, Tak-Sun Feb 25, 2026 05:45pm

- The Ministry of Food and Drug Safety (MFDS) plans to accelerate the commercialization of government-led orphan drug (treating rare diseases) development by providing regulatory support from the early stages of development.The MFDS has initiated support for the orphan drug sector through the "Overcoming Unconquered Diseases" project, the Korean ARPA-H initiative led by the government.Through this support, the MFDS aims to accelerate the commercialization of orphan drugs and improve patient access to treatment for ultra-rare diseases.In observance of "Overcoming Rare Disease Day" on the 28th, the MFDS held a briefing for the medical and pharmaceutical press to explain the current status of support and policies for rare disease treatments.In observance of "Overcoming Rare Disease Day" on the 28th, the MFDS held a briefing for the medical and pharmaceutical press. (from left) Project Manager Misun Park of the Korea Health Industry Development Institute (KHIDI); Hyeon Jin Yim, Head of the Regulatory Science Policy Promotion Division; and Division Heads Chun-rae Kim, Jae-hyun Park, and Mi-ryeong Ahn."World Rare Disease Day" falls on February 29th, the rarest day of the year that occurs once every four years. Under the Rare Disease Management Act, the Korean government commemorates the last day of February each year (typically February 28th or 29th) as Rare Disease Day. The goal is to enhance public understanding of rare diseases and improve access to treatment and medical support for patients and their families.While South Korea has designated 1,380 rare diseases, drug development remains challenging due to the small patient population and the difficulty of attracting corporate investment.The government began treatment development through the Korean-style ARPA-H project. Benchmarked after the U.S. "ARPA-H (Advanced Research Projects Agency for Health)," this project is a "high-risk, high-return" national R&D initiative that began last year.In the field of rare diseases, projects currently underway include the development of a tailored, innovative treatment platform for pediatric rare disease patients, the N-of-1 (single-patient) clinical trial project (HEART), and patient-customized gene therapy to overcome visual impairment in hereditary eye diseases (BEACON). A national budget of KRW 17.5 billion is allocated for investment over 4.5 years.Typically, national R&D projects often conclude with researchers registering papers or patents. However, this project aims for commercialization. Consequently, regulatory support from the MFDS is considered crucial.Misun Park, Project Manager of the K-Health Future Promotion Division at KHIDI, explained, "To meet regulatory requirements after development has significantly progressed can lead to irreversible losses in time and cost. It is essential to communicate with the MFDS from the early stages of development to collaborate on clinical trial design and the direction of data preparation."Furthermore, due to the nature of rare diseases, patient administration cannot be cancelled even if any issues arise during the Investigational New Drug (IND) process. Therefore, the aim is to minimize trial-and-error by consulting with the MFDS from the start of development.The MFDS provides early-stage regulatory support through the "Regulatory Adequacy Review System," which has been in place since last year. This system analyzes and supports regulatory requirements during the initial stages of national R&D projects.The system reviews how products under development are classified and which laws apply to them, and provides consultations on evaluation criteria and methods for demonstrating safety and efficacy. Through this, regulatory response strategies and the necessity of joint research with the MFDS are also reviewed.Last year, the system supported commercialization by classifying stem-cell-based artificial blood projects as advanced biopharmaceuticals and recommending GRADE changes for digital therapeutic development projects for developmental disabilities.Hyeon Jin Yim, Head of the Regulatory Science Policy Division at the MFDS, stated regarding the system, "Researchers often develop innovative technologies but face difficulties at the commercialization stage because they do not fully understand regulatory procedures. The Ministry provides guidance from the beginning on which laws apply, what data needs to be prepared, and what strategies are necessary to increase the likelihood of approval."Yim added, "Preventing delays in commercialization is possible if the time required for supplementation is shortened by analyzing regulatory targets in advance. We are currently in discussions regarding eight projects under the ARPA program."The MFDS is also working to improve accessibility by easing designation requirements for orphan drugs and implementing expedited reviews. Starting this year, drugs can receive orphan drug designation (ODD) even without submitting data demonstrating significantly improved safety or efficacy compared to existing alternatives.Chun-rae Kim, Head of the Pharmaceutical Policy Division at the MFDS, explained, "Previously, for rare disease drugs announced by the Korea Disease Control and Prevention Agency (KDCA), data proving improved safety and efficacy had to be submitted. However, through consultations with the pharmaceutical industry last year, we decided to omit this regulatory requirement."This year, the Ministry plans to discuss with the industry measures to ease regulations on orphan drug designation cancellations.When designated as an orphan drug, rapid approval can be expected through expedited regulatory reviews. The MFDS selects drugs for expedited review through the "GIFT" (Global Innovative products on Fast Track) system. Currently, of the 50 items approved as GIFT products, 42 are orphan drugs.Jae-hyun Park, Head of the Expedited Review Division at the MFDS, stated, "According to the disease groups of treatments designated as GIFT, half are recurrent or intractable cancers with small patient populations. For these patients, clinical trials themselves can be a treatment opportunity. In the future, we plan to consult with the public and private sectors to ensure that patient opinions are reflected in GIFT reviews."For orphan drugs not designated under GIFT, the MFDS also offers flexibility in reviews, granting approval based on Phase 2 clinical trials, with the requirement to submit Phase 3 clinical data post-market. Mi-ryeong Ahn, Head of the Oncology and Antibiotics Division, added, "We continue to develop guidelines related to clinical trial design to increase flexibility at the approval stage."

- Policy

- First matching-form Ofev generic listed at half price

- by Jung, Heung-Jun Feb 24, 2026 03:55pm

- A generic version of the chronic fibrotic interstitial lung disease treatment Ofev Soft Cap (nintedanib esylate) with the same formulation will be listed for reimbursement for the first time.With its reimbursement entry at a price more than 50% lower than the original, full-scale market competition is expected.According to industry sources on the 20th, Ildong Pharmaceutical’s Cuninta Soft Cap 100 mg and 150 mg will be added to the March reimbursement list.The substance patent for Boehringer Ingelheim Korea's Ofev Soft Capsules expired in January last year. Subsequently, generic companies have successively launched their versions.However, unlike the original drug, those products obtained approval in tablet formulations. From July last year, Yungjin Pharm, Ildong Pharmaceutical, Daewoong Pharmaceutical, Kolon Pharmaceutical, and others entered reimbursement. Whan In Pahrm also received approval for Ofenib Tab, but the drug is yet to be listed for reimbursement.Until now, no reimbursed generic matching Ofev’s soft capsule formulation has been available. Ildong Pharmaceutical is expected to be the first to list a soft capsule generic, Cuninta Soft Cap, following its release of Cuninta Tab.Cuninta Tab 150 mg was previously listed at KRW 13,500, roughly half the price of Ofev Soft Cap, which was priced at KRW 26,220.Although generics designated as orphan drugs could receive equivalent pricing to the original, manufacturers pursued lower prices to strengthen market competitiveness.The reimbursement ceiling prices for Cuninta Soft Cap 100 mg and 150 mg are set at KRW 8,500 and KRW 13,500, respectively. Notably, the lower dose represents about 40% of the originator’s 100 mg price of KRW 20,960.Where earlier competition strategies relied on tablet differentiation and lower pricing, manufacturers can now seek prescription expansion based on identical formulation at half the cost.Because switching prescriptions within the same formulation is expected to face less patient resistance, Ildong Pharmaceutical is anticipated to intensify its competitive positioning against Ofev.Given that Ofev entered reimbursement relatively late, 8 years after domestic approval, Ofev is expected to face intensifying competition from the later entrant generics.

- Policy

- Government to establish bioequivalence standards for complex generics

- by Lee, Jeong-Hwan Feb 24, 2026 03:55pm

- The government is moving forward with the development of guidelines, including bioequivalence evaluation standards for complex generic drugs.This initiative aims to support the rapid development of complex generics as market entry for new technology and new concept drugs increases.Formulations targeted for new assessment criteria and testing methodologies include oral agents, injectables, inhalation products, and ophthalmic preparations.On the 20th, the National Institute of Food and Drug Safety Evaluation (NIFDS) under the Ministry of Food and Drug Safety (MFDS) announced the launch of a research project titled the “New Technology and New Concept Drug Guideline Development Project”.To develop bioequivalence assessment standards and testing method guidelines for complex generics, the Ministry of Health and Welfare (MOHW) will establish a multi-layered advisory framework involving industry, academia, and regulatory experts. Policy decisions will be made through an expert committee following internal review for stage-by-stage examination and verification.The research will define the concept of complex generics and conduct comparative analyses of domestic pharmaceutical industry demand alongside guideline frameworks from major global regulatory authorities to create new guidelines.Guidelines currently operated by the US FDA, European EMA, and Japan PMDA will be analyzed. Priorities for new guideline development will be determined based on technological impact, industry needs, and regulatory necessity.Subsequently, it will present general evaluation principles applicable to all dosage forms of complex generics and publish a reference manual to support development.In addition, bioequivalence guidelines specific to complex generics will be developed. It plans to create equivalence evaluation guidelines for oral, injectable, inhaled, and ophthalmic combination generics, validate them through a separate expert advisory body, including the Ministry of Food and Drug Safety (MFDS), and then finalize them.For this year, oral formulations selected for guideline development include pentosan polysulfate sodium products, ferric citrate hydrate capsules, and mesalamine extended-release tablets.Injectable products include dexamethasone extended-release implants and paliperidone palmitate long-acting injections. Inhalation products cover budesonide, formoterol fumarate inhalation aerosols, fluticasone propionate inhalers, and fluticasone propionate/salmeterol xinafoate inhalation powders.Ophthalmic formulations include brinzolamide suspension eye drops and prednisolone acetate suspension eye drops.Notably, authorities plan to establish a collaborative framework with the task force supporting rapid drug development guidelines. Once completed, newly developed guidelines will be promoted to industry and academic stakeholders, alongside implementation activities such as conferences.NIFDS stated, “We plan to develop more than 10 bioequivalence guidelines for complex generics and publish a project report. Through technological support for complex generics, we aim to accelerate the timely commercialization of high-quality generics while strengthening review reliability and transparency through science-based guidelines.”

- Policy

- Backlash mounts to drug price reduction reform plan

- by Lee, Jeong-Hwan Feb 24, 2026 03:55pm

- The Korean pharmaceutical industry continues criticizing that the background of the Minister of Health and Welfare (MOHW)'s drug pricing system reform, which includes 'calculation criteria for impact of drug price reductions' and 'preferential drug price criteria,' is unreasonable.The MOHW calculated simulation results for losses incurred from drug price reductions based on total sales amount. However, the view is that the calculation standard itself is flawed, as sales amount includes all accounting elements involved in the manufacturing and production of medicines.Furthermore, the criticism is that preferential drug price clauses based on whether a company is certified as an Innovative Pharmaceutical Company or on its ratio of new drug Research and Development (R&D) expenditure to sales are inappropriate because they are arrived at unilaterally, without proper agreement between the government and the industry.On the 22nd, the pharmaceutical industry voiced concerns about MOHW's unilateral push for drug pricing reform, stating, "The justification for the price reduction is unclear, and such administration significantly undermines trust in the government, leading to results that run counter to the fostering of the global pharmaceutical industry."On the 20th, the Health Insurance Policy Deliberation Committee (HIPDC) subcommittee excluded the drug pricing system reform plan, including the price reduction for currently listed generics, from its agenda.The MOHW cited insufficient gathering of industry opinions and said it would continue communicating with the industry until next month's (March) HIPDC meeting.Despite the MOHW’s decision to defer or postpone the agenda, the pharmaceutical industry remains skeptical about the possibility of revisions to the reform plan. This is due to the observation that the MOHW has not shown a proactive negotiation attempts thus far.Korean pharmaceutical companies cite the MOHW's methodology for calculating the impact of drug price reductions as the biggest issue.It is reported that the MOHW, based on simulation results analyzing the financial impact after price reductions using the sales revenue of several domestic pharmaceutical companies operating the generic business, concluded that revenue losses would be minimal even if the generic price calculation rate were lowered to 40%.Furthermore, the ministry believes that its reform plan is sufficiently valid and consistent, having derived results showing that certified innovative pharmaceutical companies or those with a high proportion of new drug R&D relative to sales would remain relatively unaffected by the price reductions.Korea's domestic pharmaceutical companies maintain that if the MOHW simulates the impact of price reductions based solely on total sales revenue or simple operating profit, an accurate evaluation is impossible.The reason is that a simulation based on sales revenue calculates figures by including every accounting element without exception. In contrast, one based on operating profit excludes selling, general, and administrative (SG&A) expenses. This evaluation method is impossible to reflect the innovation of pharmaceutical companies that have substantially contributed to the development of the domestic industry.In particular, while the MOHW has stated multiple times that the purpose of this drug pricing system reform is to foster the pharmaceutical industry rather than reduce health insurance drug expenditures, the pharmaceutical industry argues that reducing generic drug prices significantly while claiming to foster the industry is contradictory.The criticism is that the ministry's administrative goal, which it seeks to achieve through price reductions, is unclear.An official from domestic Pharmaceutical Company A pointed out, "The sales revenue evaluation, which is the standard for the MOHW’s impact simulation, is flawed as it includes all accounting elements," and added, "They must divert from single standards like sales revenue, perform a value evaluation considering various factors, and then proceed with simulations in a direction that grows the pharmaceutical industry and the drug market."Then added, "The MOHW changed the health insurance listing method for drugs from a negative list to a positive list system," and added, "This implies that the governemtn will make value judgments on drug prices. Therefore, all-at-once reduction of drugs listed through this system means the government considers existing medicines to have no value and intends to suppress the market."An official from domestic Pharmaceutical Company B also expressed, "The MOHW can analyze the reduction in pharmaceutical companies' revenue quite precisely through health insurance claim amounts or supply history reports. It is puzzling why they designed the drug price reduction and the pricing system reform plan with a simulation that excludes such big data when it is available for use."The official stated, "The pharmaceutical industry will be able to trust the government again only if the MOHW discloses transparent data regarding the evidence and standards used to design the drug pricing system reform and shows a willingness to negotiate," and added, "For now, meetings between the MOHW and the pharmaceutical industry may become a superficial formality, aimed at filing a quota of superficial mutual consultations."

- Policy

- Imjudo + Imfinzi comb to enter reimb list next month

- by Jung, Heung-Jun Feb 23, 2026 09:16am

- AstraZeneca Korea's liver cancer treatment, Imjudo (tremelimumab), will be included in the reimbursement list next month. This follows three months after the Drug Benefit Evaluation Committee (DBEC) approved combination therapy with Imfinzi.It is reported that a ceiling price of KRW 16.5 million has been set for this newly listed high-cost drug. Treatment access to hepatocellular carcinoma treatment is expected to improve significantly.According to industry sources on the 20th, AstraZeneca Korea's Imjudo Injection (0.3g/15mL) will be reimbursed starting in March.In November last year, the DBEC approved the reimbursement appropriateness of Imjudo as 'first-line treatment of adult patients with advanced or unresectable hepatocellular carcinoma in combination with durvalumab.'The listing process proceeded smoothly as drug price negotiations with the National Health Insurance Service (NHIS) began in December. Following the conclusion of price negotiations, insurance coverage is scheduled to begin in March.Imjudo was a drug for which requests for rapid listing were made during the Ministry of Health and Welfare (MOHW)'s National Assembly audit last year. At that time, the National Assembly inquired about plans to expand the reimbursement evaluation method, given the drug's distinct single-dose administration.According to the MOHW's response at the time, an application for health insurance coverage for Imjudo was filed in March last year, and the DBEC conducted a review of the drug cost comparison criteria in September of the same year.However, the DBEC delivered a reconsideration decision regarding the combination therapy with Imfinzi last September. After that, Imjudo's appropriateness for reimbursement was recognized during the DBEC reconsideration in November.Analysis suggests that the government's designation of a flexible application of the Incremental Cost-Effectiveness Ratio (ICER) value for Imjudo, second since the ADC anticancer drug 'Trodelvy (sacituzumab govitecan)', facilitated the smooth winding up of the drug price negotiations.

- Policy

- Recall of GSK's antiviral 'Valtrex Tab 500mg' over impurities

- by Lee, Tak-Sun Feb 23, 2026 09:16am

- Antiviral medication 'Valtrex Tab 500mg,' used to treat shinglesA recall has been initiated for certain batches of GlaxoSmithKline's antiviral medication, Valtrex Tab 500mg (valacyclovir hydrochloride), after nitrosamine impurities were detected above the permissible limit.This is the first recall of a valacyclovir-containing formulation due to impurities.The Ministry of Food and Drug Safety (MFDS) announced on the 20th that it has issued an operator-led recall order for specific manufacturing units of Valtrex Tab. 500mg that exceeded the Acceptable Daily Intake (ADI) of the nitrosamine impurity N-nitroso-N-ethyl-valacyclovir.The affected batch numbers are V53B (expiry 2027-04-24) and YR9K (expiry 2027-06-04).This product received domestic approval in 2005 and is indicated for ▲Shingles ▲Treatment of initial and recurrent genital herpes infections ▲Suppression of recurrent genital herpes infections ▲Reduction of transmission of genital herpes when used as suppressive therapy in combination with safer sex practices ▲Prophylaxis of cytomegalovirus (CMV) infection following kidney transplantation ▲Ccold sores ▲Treatment of chickenpox in immunocompetent pediatric patients aged 2 to under 18 years.As of 2024, the import performance of the drug totalUSD 4,137,731 (approximately KRW 6 billion). The ADI for N-nitroso-N-ethyl-valacyclovir in valacyclovir components is set at 400ng per day.The announced impurity is N-nitrosamine, a potential carcinogen and mutagen that can be generated at the ethylamine site of valacyclovir. It is known to form in trace amounts during the synthesis of the Active Pharmaceutical Ingredient (API) itself or through reactions during storage.Currently, 17 valacyclovir products are approved for sale in the Korean market. Attention is now focused on whether the recall of the original product will expand to include generic versions.

- Policy

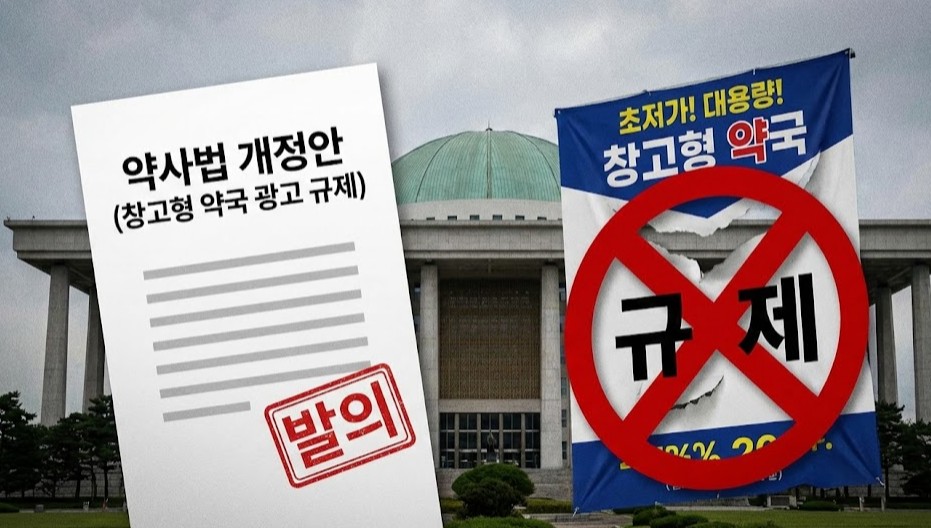

- Regulations on INN prescribing·warehouse pharmacies

- by Lee, Jeong-Hwan Feb 20, 2026 10:04am

- It is highly likely that bills to mandate International Nonproprietary Names (INN) prescribing limited to supply-unstable drugs designated by the government, as well as bills to strengthen regulations on the signage, advertising, and opening scale standards of warehouse-type pharmacies, will be considered at the National Assembly Health and Welfare Committee's Legislation Subcommittee scheduled for the end of this month.This is because the decision by the lawmakers who proposed the relevant legislation to request the ruling and opposition party leadership of the Health and Welfare Committee to prioritize the review of the limited generic prescribing bill and the bill aimed at resolving drug misuse and abuse caused by the opening of warehouse-type pharmacies.On the 13th, the Health and Welfare Committee requested that ruling and opposition members submit the agenda for the First Legislation Subcommittee, which is expected to be held on the 26th.However, sources report that since the February subcommittee schedule falls immediately after the Lunar New Year holiday, and the leadership has agreed to the March plenary session, the New Year's business reports from relevant ministries, and the holding of the subcommittee, each lawmaker's office has been advised to submit only one agenda item.Despite this limitation, the bill to strengthen the supply chain for supply-unstable drugs and mandate limited generic prescribing, along with the bill to regulate the signage, advertising, and opening scale of warehouse-style pharmacies, are expected to be the top priority for the February subcommittee.Both bills are considered bills affecting daily lives, and resolving the drug supply instability issue is a national task of the new administration. Furthermore, the bill to strengthen regulations on warehouse-type pharmacies has gained urgency as large-scale warehouse-type pharmacies have recently opened in Seoul and other parts of the country, intensifying the debate between proponents and opponents and increasing the need to address potential side effects through legislative review.The bill details to resolve the drug supply instability crisis allows the Minister of Health and Welfare to designate supply-unstable drugs through the deliberation of the Drug Supply Management Committee. Among these, for drugs designated for emergency production or import, the bill permits pharmaceutical companies (manufacturers and importers) to place emergency production or import orders.Notably, the bill mandates that physicians write the generic name rather than the brand name on prescriptions for supply-unstable drugs, with penalties for violations. This provision aims to support the safe supply of medicines to patients by mandating limited generic prescribing.Representative Jang Jong-tae, who proposed the bill to resolve the drug supply instability issue, stated his legislative intent: "Recently, drug supply instability has been occurring frequently due to reasons such as temporary surges in demand, suspension of supply, and difficulties in securing raw materials," added, "Despite being a problem that threatens the public's right to health and causes confusion in the healthcare field, the current law lacks provisions regarding the response to drug supply instability."The bill to regulate warehouse-type pharmacies primarily prohibits the use of terms such as 'warehouse,' 'plant,' or 'factory' on pharmacy signs or promotional materials. It also mandates a preliminary review by the Pharmacy Opening Committee under the provincial governor or metropolitan mayor when an individual intends to register the opening of a pharmacy above a certain scale.The legislative goal is to prevent the incitement of excessive drug consumption and misuse among consumers and to strengthen the preliminary review authority of local governments and pharmacist associations regarding the opening of deformed pharmacies.Democratic Party Representatives Seo Young-seok, Nam In-soon, Kim Yun, Jeon Hyun-hee, and Jang Jong-tae have each proposed related legislation.An official from a ruling party member’s office on the Health and Welfare Committee explained, "We plan to submit the agenda items for the February subcommittee within the deadline," added, "The bill to resolve the drug supply instability crisis has high necessity and urgency for discussion, so we plan to request it as a first-priority bill for tabling."Another official from a ruling party member’s office stated, "As warehouse-type pharmacies have opened in several locations, it has become a national interest. The Ministry of Health and Welfare has also begun drafting regulations to prevent side effects, such as drug misuse, at warehouse-type pharmacies," and concluded, "It is necessary to accelerate the legislative review."