- LOGIN

- MemberShip

- 2026-03-10 07:55:21

- Company

- US tariffs on pharmaceuticals forecast…K-bio closely monitors

- by Chon, Seung-Hyun Jan 28, 2026 08:12am

- U.S. President Donald Trump showed his intent to impose a 25% tariff on pharmaceuticals. Korea's major pharmaceutical companies devised countermeasures by acquiring U.S.-based manufacturing plants. The Korean pharmaceutical industry is also closely watching the continuously changing imposition of tariffs.ChatGPT-generated imageOn January 26, 2026, President Trump posted on Truth Social, "The South Korean National Assembly has failed to implement previously agreed trade measures," adding, "An immediate increase in tariffs on Korean woods, pharmaceuticals, and all other reciprocal goods from 15% to 25%.In October 2025, during the APEC summit in Gyeongju, Korea and the U.S. reached a Most Favored Nation agreement for pharmaceuticals. This deal detailed that tariffs on South Korean medicines would not exceed 15%.According to the details of the agreement disclosed last month, the White House released a South Korea-U.S. Summit Joint Fact Sheet (JFS) that includes an agreement to ensure that tariffs on South Korean pharmaceutical products do not exceed 15%. It was finalized that in any case where tariffs are imposed on pharmaceuticals, the rate will not exceed 15%. For generics, it was decided to apply zero tariffs.The KoreaBIO Association stated, "While it was agreed in the Korea-U.S. trade agreement to apply a maximum of 15% if Section 232 tariffs are applied to pharmaceuticals, it will be difficult to rule out the possibility of a tariff increase to 25% through future amendments to the trade agreement."President Trump has also mentioned the possibility of imposing 100% tariffs on branded pharmaceuticals since October of last year.Through Truth Social on September 25 last year, President Trump stated, "Starting the 1st of next month, a 100% tariff will be imposed on all branded and patented pharmaceuticals from companies that are not building pharmaceutical production plants within the United States." adding, "'IS BUILDING' means a state where groundbreaking has occurred or construction is underway," and "In cases where construction has started, no tariffs will be imposed on the corresponding pharmaceuticals." However, no official tariff measures regarding pharmaceuticals have been announced to date.Korean pharmaceutical and biotech companies with high export volumes to the U.S. are in a state of high alert regarding pharmaceutical tariff rates. Domestic pharmaceutical and biotech companies without local plants in the U.S. have no choice but to closely watch the trend, as U.S. pharmaceutical tariff rates can impact their market penetration.However, it has been suggested that even if tariff rates rise, the direct blow will not be significant for Celltrion and Samsung Biologics, which export the most pharmaceuticals from Korea to the U.S., as they have established countermeasures by acquiring local plants.Celltrion has shown the most preemptive movement in preparation for U.S. tariffs. In September last year, Celltrion's subsidiary, Celltrion USA, signed a formal contract to acquire a biopharmaceutical production plant located in Branchburg, New Jersey, from ImClone Systems Holdings, a subsidiary of Eli Lilly. The acquisition amount is approximately $330 million (about KRW 460 billion). Celltrion received approval from Irish competition authorities in October last year and finally completed the acquisition process in November after the finalization of the business combination review by the U.S. Federal Trade Commission (FTC).Celltrion USA production facility opening ceremony held in June (from left: Kee Woo-sung, Vice Chairman of Celltrion; Todd Winge, CEO of Celltrion Branchburg; Park Kyung-ok, Senior Vice Chairman of Celltrion Holdings; Seo Jung-jin, Chairman of Celltrion Group; U.S. Senator Andy Kim of New Jersey; U.S. Representative Thomas Kean Jr. of New Jersey; Thomas Young, Mayor of Branchburg Township; Seo Joon-seok, Head of Celltrion North America Headquarters).The U.S. production facility acquired by Celltrion is a large-scale campus equipped with a total of four buildings, including production facilities, logistics warehouses, a technical support building, and an operation building on a site of approximately 148,500㎡, capable of producing about 66,000 liters of drug substance (DS). Celltrion plans to enter into an immediate expansion process and invest an additional KRW 700 billion to expand production capacity to a total of 132,000 liters.A Celltrion official explained, "By securing the production facility in Branchburg, New Jersey, we have prepared a fundamental solution regarding tariffs and have structurally escaped from all risks.Samsung Biologics signed a contract last December with GlaxoSmithKline (GSK) to acquire the Human Genome Sciences (HGS) biopharmaceutical production facility located in Rockville, Maryland. This involves an investment of $280 million (approximately KRW 410 billion) by Samsung Biologics America, the U.S. subsidiary of Samsung Biologics, to acquire the plant. The asset acquisition process is scheduled to be completed within the first quarter of this year.View of the Human Genome Sciences biopharmaceutical production facility located in Rockville, Maryland. The Rockville production facility is a drug substance production plant with a total capacity of 60,000 liters located in the center of the Maryland bio-cluster, consisting of two manufacturing buildings. The facility is equipped with infrastructure capable of supporting the production of antibody drugs at various scales, from clinical stages to commercial production.This is Samsung Biologics' first acquisition of an overseas plant. Samsung Biologics operates five plants in Songdo, Incheon. All five plants were constructed using internally procured funds.It appears that biotech companies with large U.S. export volumes have completed preparations for tariff risks by investing a total of over KRW 1 trillion to acquire local plants.According to the Ministry of Food and Drug Safety, South Korea's pharmaceutical export volume to the U.S. in 2024 was $1.49117 billion (approximately KRW 2 trillion), accounting for 16.1% of the $9.28987 billion total export volume of domestically produced pharmaceuticals. Among pharmaceutical exports to the U.S. in 2024, finished pharmaceutical products accounted for $1.29899 billion, or 87.1%, while active pharmaceutical ingredients (API) were only $192.19 million, or 16.9%. Samsung Biologics and Celltrion in the U.S. export of domestically produced pharmaceuticals occupy the most.For Samsung Biologics, U.S. regional sales accounted for KRW 1.1741 trillion, or 25.8% of its KRW 4.5473 trillion total revenue in 2024. Samsung Biologics' U.S. revenue share recorded 28.5% and 26.3% in 2022 and 2023, respectively. Samsung Biologics calculates regional revenue based on the location of its CDMO clients. Samsung Biologics' cumulative U.S. revenue for the third quarter reached KRW 1.6482 trillion, surpassing last year's export volume. U.S. sales accounted for 38.8% of Samsung Biologics' KRW 4.2484 trillion cumulative revenue through the third quarter. For Celltrion, biopharmaceutical sales in the North American market reached KRW 1.0453 trillion in 2024. Celltrion's North American market sales decreased 11.3% from KRW 709.5 billion in 2022 to KRW 629.2 billion in 2023, but increased by 66.1% in 2024 compared to the previous year, surpassing KRW 1 trillion for the first time.

- Company

- New AML drug Vanflyta approved in Korea

- by Son, Hyung Min Jan 28, 2026 08:12am

- Daiichi Sankyo Korea (CEO Jeong-tae Kim) announced on the 26th that its acute myeloid leukemia (AML) targeted therapy Vanflyta (quizartinib) has been approved in Korea.With this approval, Vanflyta can now be used in combination with standard cytarabine and anthracycline induction and standard cytarabine consolidation therapy, and as a maintenance mono therapy following consolidation therapy, for adult patients with newly diagnosed acute myeloid leukemia that is FLT3-ITD-positive.AML accounts for approximately 23.1% of all leukemia cases worldwide, and around 2,000 adults are newly diagnosed with AML each year in Korea. FLT3 mutations are the most commonly reported genetic alterations in AML, with approximately 25% of newly diagnosed AML patients harboring the FLT3-ITD mutation. The FLT3-ITD mutation is associated with a high disease burden and poor prognosis, including shortened overall survival.The efficacy and safety of Vanflyta were evaluated over a long-term period of more than five years in the Phase III QuANTUM-First trial, a randomized, double-blind, placebo-controlled study involving 539 patients with newly diagnosed FLT3-ITD–positive AML.Patients enrolled in the study received induction and consolidation combination therapy followed by up to 3 years of maintenance monotherapy with Vanflyta, regardless of whether they underwent allogeneic hematopoietic stem cell transplantation.Results showed a 22% reduction in the risk of death in the Vanflyta group compared with the placebo group. At a median follow-up of 39.2 months, the median overall survival (mOS) was 31.9 months in the Vanflyta group, an extension compared with 15.1 months in the placebo group.Jeong-tae Kim, CEO of Daiichi Sankyo Korea, stated, “We are very pleased to be able to provide a new first-line treatment option for patients with poor prognosis FLT3-ITD mutation-positive AML with the approval of Vanflyta. Following solid tumors, we are now introducing a therapy that can improve treatment outcomes in hematologic malignancies as well. We will continue our endeavors to make meaningful progress to expand treatment access for more patients in Korea.”Byung-sik Cho, Chair of the Acute Myeloid Leukemia/Myelodysplastic Syndrome Working Group of the Korean Society of Hematology (Professor of Hematology at Seoul St. Mary’s Hospital), said, “Vanflyta has been confirmed to extend both complete remission duration and overall survival when administered as maintenance therapy following induction and consolidation therapy, added to standard chemotherapy in newly diagnosed FLT3-ITD mutation-positive AML patients based on its mechanism that selectively targets the FLT3-ITD mutation. This is expected to bring an important change to AML treatment strategies in Korea.”

- Company

- Rhapsido soon to be launched in Korea

- by Son, Hyung Min Jan 28, 2026 08:11am

- A shift in the treatment landscape for chronic spontaneous urticaria (CSU) is imminent. With Novartis positioning an oral BTK inhibitor as a successor to Xolair, competition over treatment options for antihistamine-refractory patients is entering a new phase.Novartis’s Rhapsido (remibrutinib)According to industry sources on the 28th, Novartis Korea has recently completed its regulatory submission for Rhapsido (remibrutinib). Approval is expected within the first half of this year.Rhapsido is an oral targeted therapy that inhibits Bruton’s tyrosine kinase (BTK), a key pathway in the pathophysiology of CSU, thereby blocking the release of histamine and inflammatory mediators. The drug was approved in the United States last September for the treatment of adult CSU patients whose symptoms persist despite second-generation H1 antihistamines.One of Rhapsido’s most notable features is its oral formulation, taken twice daily. Until now, treatment options for patients unresponsive to first-line antihistamines have been largely limited to the injectable biologic Xolair (omalizumab). The arrival of Rapsido opens a new option, an oral targeted therapy.According to the Phase III REMIX-1·2 clinical trial results, which formed the basis for its U.S. FDA approval, Rhapsido demonstrated superiority over placebo in improving itch severity (ISS7), hive severity (HSS7), and total urticaria activity score (UAS7) starting from Week 2. Approximately one-third of patients achieved complete remission (defined as zero itch and zero hives) by Week 12.In terms of safety, the drug showed a favorable profile, being stable enough not to require laboratory monitoring. Common adverse events were mild and included nasopharyngitis, headache, and abdominal pain.Following the US approval, Novartis has submitted Rhapsido for approval in major markets, including the EU, Japan, and China, where it has received priority review status. With formal submission completed in Korea as well, the entry of the first oral targeted therapy for CSU is imminent.Beyond CSU, Novartis is also expanding clinical development of Rhapsido across a range of immune-mediated diseases, including chronic inducible urticaria (CIndU), hidradenitis suppurativa (HS), food allergy, and multiple sclerosis.BTK inhibitors emerge as a successor to biologics in CSUCompetition in the CSU treatment market is rapidly intensifying around BTK inhibitors.BTK inhibition was first established in hematologic malignancies such as B-cell lymphomas and leukemia. Starting with the first-generation agent Janssen’s Imbruvica (ibrutinib), second-generation drugs BeiGene’s Brukinsa (zanubrutinib) and AstraZeneca’s Calquence (acalabrutinib), and third-generation Lilly’s Jaypirca (pirtobrutinib), have rapidly expanded their market share as later entrants.With the mechanistic advantages of BTK inhibition having also been confirmed in autoimmune diseases, later entrants are increasingly targeting these indications in drug development.Sanofi’s WayrilzNotably, Sanofi is strengthening its BTK inhibitor lineup in addition to its IL-4/13 inhibitor Dupixent (dupilumab).In September last year, Sanofi received US approval for the BTK inhibitor Wayrilz (rilzabrutinib) for immune thrombocytopenia (ITP). The drug has now advanced into Phase III trials for chronic inducible urticaria(CIU) and CSU.While Rhapsido achieves sustained BTK inhibition through irreversible binding, Wayrilz employs a hybrid mechanism combining reversible and irreversible binding.Sanofi is also developing another BTK inhibitor, tolebrutinib. However, development has recently been put to a stop after the FDA issued a Complete Response Letter (CRL).This treatment had garnered expectations for its mechanism of action, which selectively suppresses the immune response in multiple sclerosis by regulating B lymphocytes and disease-associated microglia. However, the requirement for additional data has rendered the approval timeline uncertain.

- Company

- Galderma 'Nemluvio' for atopic dermatitis·PN wins nod in KOR

- by Son, Hyung Min Jan 27, 2026 06:55am

- Product photo of NemluvioGalderma Korea (CEO Jaihyuk Lee) announced that Nemluvio (nemolizumab), a biologic that selectively blocks the interleukin (IL)-31 receptor, received domestic approval on the 23rd for the treatment of moderate-to-severe atopic dermatitis and prurigo nodularis.With this approval, Nemluvio has become the only treatment option for moderate-to-severe atopic dermatitis that allows the dosing interval to be extended to every eight weeks, reducing the treatment burden on patients by reducing the frequency of administration.Nemluvio is the world's first monoclonal antibody that selectively blocks IL-31 receptor alpha, thereby inhibiting the IL-31 signaling pathway. IL-31 ia primary cause of itching.IL-31 is a neuro-immune cytokine that induces repetitive scratching behavior by directly stimulating nerves and activating sensory neurons that transmit itch signals. In addition to triggering itch, it serves as a quadruple trigger deeply involved in the fundamental pathophysiology of atopic dermatitis and prurigo nodularis, including inflammatory expression, epidermal dysregulation, and skin fibrosis.The basis of Nemluvio approval was the results of the Phase 3 ARCADIA and OLYMPIA clinical trials.ARCADIA 1 and 2 were randomized, double-blind, placebo-controlled, global Phase 3 clinical studies conducted in 941 and 787 patients, respectively, aged 12 and older with moderate-to-severe atopic dermatitis, to evaluate the efficacy and safety of Nemluvio over 48 weeks.The clinical results showed that Nemluvio+topical corticosteroids (TCS) or topical calcineurin inhibitors (TCI), met all endpoints compared to the placebo group.The proportion of patients achieving at least 75% improvement in the Eczema Area and Severity Index (EASI-75) was 43.5% and 42.1% in the Nemluvio+TCS/TCI treatment groups in the ARCADIA 1 and 2 studies, respectively, compared to 29% and 30.2% in the placebo groups, demonstrating a statistically significant difference between the two groups.In particular, a statistically significant difference in pruritus compared to the placebo group was observed starting from 48 hours after administration, confirming Nemluvio's rapid itch-relief effect. At weeks 4 and 16, more than twice as many patients in the Nemluvio+TCS/TCI group experienced clinically meaningful itch relief (PP-NRS improvement of 4 points or more) compared to the placebo group.OLYMPIA 1 and 2 were conducted on 286 and 274 adult patients, respectively, aged 18 and older, with moderate-to-severe prurigo nodularis. In these trials, Nemluvio monotherapy met all endpoints compared to the placebo group.Nemluvio demonstrated a consistent safety profile across all clinical programs. The incidence of serious adverse events (SAE) was similar to that of the placebo group, and most adverse events were mild to moderate and manageable.Yang Won Lee, President of the Korean Atopic Dermatitis Association (Department of Dermatology, Konkuk University Hospital), explained, "Atopic dermatitis and prurigo nodularis are chronic inflammatory neuro-immune diseases where symptoms such as 'itching' cause chronic insomnia, fatigue, and various psychological stresses, seriously degrading the quality of life for patients."Lee added, "With the introduction of a new biologic targeting the IL-31 receptor, a key pathway for itching, to the domestic market, we hope to alleviate the suffering of patients with moderate-to-severe atopic dermatitis and prurigo nodularis and see another meaningful advancement in long-term disease management."CEO Jaihyuk Lee, stated, "Based on our long-standing expertise in the field of dermatology, Galderma has introduced a new biological treatment option that can meet the unmet medical needs of patients with atopic dermatitis and prurigo nodularis. We expect Nemluvio, the first to directly inhibit the interleukin-31 pathway, to provide patients with more effective and sustainable treatment opportunities and bring substantial changes to their daily lives."Galderma Korea plans to launch Nemluvio in the second half of this year. The company has completed the application for health insurance reimbursement listing to secure faster access to treatment for patients with atopic dermatitis and prurigo nodularis.

- Company

- Biologic for asthma, 'Nucala' autoinjector can be prescribed

- by Eo, Yun-Ho Jan 27, 2026 06:54am

- Product photo of Nucala Auto-InjectorThe injectable formulation of the antibody medicine Nucala is entering the prescription area of general hospitals.GSK's Nucala Auto-Injector (mepolizumab), a treatment for severe neutrophilic asthma, has passed the drug committees (DC) of tertiary general hospitals, including Samsung Medical Center Seoul and Seoul National University Hospital, as well as medical institutes, including Kangdong Sacred Heart Hospital, Soon Chun Hyang University Hospital Cheonan, Jeonbuk National University Hospital, and Ajou University Hospital. Nucala Auto-Injector was approved in Korea in March of last year and was launched as a non-reimbursed drug in November of the same year after securing a distribution channel and quantity of stocks. Nucala Auto-Injector conditionally passed the Drug Benefit Evaluation Committee (DBEC) of the Health Insurance Review and Assessment Service (HIRA) on the 15th. Attention is focused on whether Nucala would succeed in obtaining reimbursement listing following the launch of the new formulation and the expansion of areas.Indications for the new autoinjector formulation have been added beyond the treatment of severe eosinophilic asthma in ▲existing adult and adolescent patients aged 12 and older to include eosinophilic granulomatosis with polyangiitis (EGPA) in adults and ▲hypereosinophilic syndrome (HES) in adults.Nucala is a self-administered injectable used to treat eosinophilic diseases. It is indicated as an add-on maintenance therapy for severe eosinophilic asthma (SEA) in patients aged 12 and older, for adult patients with EGPA, and for adult patients with HES, excluding those who are FIP1L1-PDGFRα-positive.The autoinjector formulation offers patients the convenience of self-administering the drug at home. This has been demonstrated through a self-administration success rate of over 96%, high patient preference, and ease of use.Meanwhile, Nucala is demonstrating increased competitiveness by securing an indication for chronic obstructive pulmonary disease (COPD). This medication received additional approval from the U.S. FDA this May as an 'add-on maintenance treatment for adult COPD patients with an eosinophilic phenotype.'The approval was granted based on the results of the Phase 3 MATINEE and METREX studies. In these studies, among a broad spectrum of COPD patient groups with an eosinophilic phenotype, the Nucala-administered group showed a significantly lower annual rate of moderate to severe exacerbations compared to the placebo group.

- Company

- Janssen enters price negotiations for Opsynvi’s reimb in KOR

- by Eo, Yun-Ho Jan 27, 2026 06:54am

- Attention is growing over whether a newly reimbursed treatment option will emerge in the underserved field of pulmonary arterial hypertension (PAH).According to Dailypharm coverage, Janssen Korea accepted the ‘price below the assessed amount’ proposed by the Health Insurance Review and Assessment Service's Drug Reimbursement Evaluation Committee last December and recently began price negotiations with the National Health Insurance Service for the pulmonary arterial hypertension (PAH) treatment ‘Opsynvi (macitentan/tadalafil).’The final approved indication for Opsynvi that passed DREC is “long-term treatment of adult patients with WHO Functional Class II–III pulmonary arterial hypertension.”Opsynvi, which received approval in the United States in March 2024 and in Korea in July last year, is a fixed-dose combination of the PDE5 inhibitor Cialis (tadalafil) and the endothelin receptor antagonist (ERA) Opsumit (macitentan). Its key advantage lies in improved dosing convenience.The efficacy of Opsynvi was demonstrated in the Phase III A DUE trial, which compared the efficacy and safety of the Opsynvi combination therapy with monotherapy using either Opsumit or Cialis.After 24 months of follow-up, Opsynvi showed up to a 29% greater reduction in pulmonary vascular resistance (PVR), the primary endpoint, compared with either Opsumit or Cialis monotherapy.As of 2023, the number of PAH patients in Korea is estimated at approximately 3,600, with the average patient profile being women in their 40s, who often play central roles in both society and family life. While the 5-year survival rate has significantly improved compared to the past, 3 out of 10 pulmonary arterial hypertension patients in Korea still die within 5 years.PAH is a rare, intractable, and progressive disease, in which delaying disease progression has a direct impact on patients’ quality of life and survival. To date, no curative pharmacologic treatment has been established, and existing therapies primarily aim to relax thickened pulmonary arteries to alleviate symptoms.Meanwhile, the emergence of new drugs is expected to transform the domestic PAH treatment landscape.In June 2025, Bayer’s Adempas (riociguat) was added to the reimbursement list nearly 10 years after its initial approval. Winrevair (sotatercept) by MSD Korea, selected for the ‘Approval-Evaluation-Negotiation Parallel Review Project, is currently undergoing reimbursement procedures.

- Company

- Kisqali attempts reimb in early breast cancer

- by Eo, Yun-Ho Jan 26, 2026 04:39pm

- Following Verzenio's failed attempt to expand coverage for early-stage breast cancer, Kisqali has now stepped forward to tackle the same challenge.According to Dailypharm coverage, Novartis Korea submitted an application last September to expand coverage for Kisqali (ribociclib), a CDK4/6 inhibitor, as adjuvant therapy in patients with high-risk Stage II and Stage III HR+ (hormone receptor positive)/ HER2- (human epidermal growth factor receptor 2 negative) early breast cancer. The company submitted the application last September and is awaiting its application to be reviewed by the Health Insurance Review and Assessment Service's Cancer Disease Review Committee later this year.With Verzenio (abemaciclib), which shares the same CDK4/6 inhibition mechanism, having failed to clear the Cancer Disease Review Committee hurdle, attention is now focused on whether Kisqali can achieve a different outcome.In the early breast cancer setting, Verzenio struggled from its first attempt. After a six-month wait following its application submission, the drug was first reviewed by the Cancer Disease Review Committee in May 2023, but reimbursement criteria were not established. Lilly resubmitted the application 5 months later in October, and the drug was reviewed again in March and July of last year—only to meet the same outcome.This suggests that Kisqali’s reimbursement journey may also be challenging. In particular, the lack of overall survival (OS) data, which proved to be a major stumbling block for Verzenio, remains a key issue. In early-stage cancer, generating OS data is inherently difficult.While Kisqali is expected to improve OS, direct data is not available yet. Invasive disease-free survival (iDFS) is used as a clinically meaningful surrogate endpoint with a strong correlation to OS in early breast cancer due to the disease characteristics. Kisqali demonstrated encouraging results in the NATALEE study.Study results showed that for the primary endpoint, iDFS at 4 years was 88.5% for the Kisqali combination therapy group and 83.6% for the endocrine therapy alone group, representing an absolute improvement of 4.9 percentage points. The risk of invasive disease progression or death was reduced by 28.5% in the Kisqali group compared to the endocrine therapy alone group.Furthermore, according to the 5-year NATALEE data presented at ESMO 2025, the Kisqali combination therapy reduced the risk of invasive disease progression or death by 28.4% compared to endocrine therapy alone. The 5-year iDFS was 85.5% in the Kisqali combination group and 81.0% in the endocrine therapy alone group, demonstrating a clinically meaningful 4.5% improvement.Meanwhile, treatment for early-stage breast cancer patients involves local therapies such as surgery or radiation therapy, along with systemic adjuvant therapies like chemotherapy and endocrine therapy. Endocrine therapy-based treatment is the standard therapy for HR+/HER2- early-stage breast cancer.In the early 2000s, aromatase inhibitor monotherapy or tamoxifen, combined with ovarian function suppression therapy for premenopausal patients, was recommended for HR+/HER2- early breast cancer patients. The goal of adjuvant therapy is to eliminate micrometastases, reduce the risk of recurrence, and prolong patient survival.For high-risk early-stage breast cancer patients (stages II-III) with a high risk of recurrence, the risk of recurrence continues to rise over time even after completing standard endocrine therapy following surgery, presenting limitations in improving long-term prognosis. Reported recurrence rates range from 6–22% within five years and 22–52% over 20 years, highlighting a persistent unmet medical need.

- Company

- Pharma in Hyangnam "Unstable employment cannot yield good medicine production"

- by Chon, Seung-Hyun Jan 23, 2026 08:39am

- Landscape of Hyangnam Pharmaceutical ComplexThe pharmaceutical industry gathered at the Hyangnam Pharmaceutical Complex to appeal for a halt to the government's drug price reduction plans. Workers at the complex, where many small and mid-sized pharmaceutical companies are located, expressed fears of job instability, and the possibility of future labor struggles was raised.The "Emergency Response Committee for Drug Price System Reform for the Development of the Pharmaceutical and Biotech Industry" (the Committee), composed of major industry organizations, held a labor-management meeting on the 22nd at the Hyangnam Pharmaceutical Complex in Hwaseong, Gyeonggi Province. The Committee requested a reconsideration of the government's reform. The committee is consisted of the Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA), the Korea Biomedicine Industry Association, the Korea Pharmaceutical Traders Association, the Korea Drug Research Association, and the Korea Pharmaceutical Industry Cooperative.The event was organized for the Committee and the labor-management of the Hyangnam complex to review the risks and impact that the reform plan, which includes large-scale price cuts, would have on the industry and production sites.The event's participants warned, "The large-scale drug price cuts pushed by the government are a declaration of abandonment of the future of the domestic pharmaceutical industry, run counter to the demand of these days for job stability, and collapse the national health safety net."In November last year, the MOHW reported to the Health Insurance Policy Review Committee its plan to lower the price calculation rate for generics and patent-expired drugs from 53.55% to around 40%. The reform is scheduled to be finalized by the Health Insurance Policy Review Committee in February and implemented in July. A month after a press conference held at the KPBMA in Seocho-gu on the 22nd of last month, the pharmaceutical industry once again publicly stated dissatisfaction against the government.The "Emergency Response Committee for Drug Price System Reform for the Development of the Pharmaceutical and Biotech Industry" (the Committee), composed of major industry organizations, held a labor-management meeting on the 22nd at the Hyangnam Pharmaceutical Complex in Hwaseong, Gyeonggi Province. Participants stated, "If the government's reform is implemented as is, it will result in the virtual collapse of the domestic pharmaceutical industry and lead to fatal consequences that jeopardize the health and lives of the public." Hyangnam Pharmaceutical Complex is Korea's largest pharmaceutical production hub, housing 39 business sites from 36 companies.Attendees unanimously agreed that rapid price cuts could deal a severe blow to the entire industry, including job instability, a contraction in R&D investment, and a weakened production base.Participants stated, "If rapid and unprecedented price cuts are implemented, the damage will be concentrated on domestic pharmaceutical companies, including those in Hyangnam, making a loss of up to KRW 3.6 trillion." The industry fears that deteriorating profitability will hinder investment in facilities for quality innovation, infrastructure improvements, and R&D.Oh Sang-jun, Chairman of the Southern Gyeonggi branch of the Chemical Workers' Union under the Federation of Korean Trade Unions (FKTU), voiced his opinion, saying, "Workers may fear job instability due to the government's price cuts. If employment is unstable, good medicine cannot be produced. The government should stop pushing unilaterally and instead consult with pharmaceutical workers to implement an effective drug pricing policy. If necessary, we will resort to struggle."Labor and management representatives from the five organizations in the Committee predicted that more than 10% of the industry's 120,000 workers would inevitably face unemployment. They also pointed out that a contraction in the production of low-profit essential medicines and domestic ethical drugs would ultimately increase reliance on expensive imported drugs, causing serious problems for public health.The labor-management representatives emphasized, "Stop the unilateral push for drug price cuts and guarantee job stability in the domestic pharmaceutical industry," and added, "Officials in charge of healthcare safety should actively foster the industry." Officials from companies in the Hyangnam complex also repeatedly highlighted the side effects.Wonsuk Lee, CEO of Daehan Nupharm, urged, "The reform plan is becoming a profitability shock to small and mid-sized domestic pharmaceutical companies, highly dependent on generics. Small businesses will be unable to handle even the fixed costs for facility investment and quality control. Before pushing an unreasonable plan that ignores the industry's reality, please prepare a reasonable alternative through communication."Lee Deok-hee, Chairman of the Il-dong Pharmaceutical labor union, said, "We have had the unfortunate experience of conducting restructuring due to liquidity limits while continuously making bold investments of 20% of sales to grow future competitiveness," and added, "Price cuts will lead to permanent workers becoming temporary workers and indirect employment leading to dismissals, which could greatly shake the job stability and the very existence of the pharmaceutical industry."On this day, the Medicine and Cosmetics Division of the National Federation of Chemical Workers' Unions under the FKTU issued a statement calling for a "full reconsideration of the drug price system reform and the protection of pharmaceutical jobs."The Medicine and Cosmetics Division urged: ▲reconsideration of the reform, ▲the establishment of a social discussion body involving pharmaceutical workers and unions, and ▲the preparation of measures to protect jobs and ensure employment stability.Lee Dong-in, Executive Secretary of the division, suggested the possibility of a struggle, stating, "We will respond strongly against job instability and restructuring caused by the reform," and added, "We will inform the public of the voices of pharmaceutical workers through various means and continuously raise issues regarding the reform plan."Yunhong Noh, President of the KPBMA, argued, "If the reform is forced through in its original form, the industrial foundation will collapse, and the production of essential medicines will contract. Hyangnam, which is home to small- and mid-sized companies, could face job instability and economic contraction due to changes in the business environment," and "A policy that ignores the voices of the industrial field can never succeed."Cho Yong-jun, Chairman of the Korea Pharmaceutical Industry Cooperative, appealed, "The generic drug price reform plan could pose serious business risks to small and mid-sized pharmaceutical companies," and added, "Rather than a unilateral cut, a phased approach is needed after analyzing the practical impact on employment and investment. Rapid change destroys even the best policy's ecosystem. Companies should be allowed enough time to improve their system."

- Company

- 'Drug pricing reform will improve patient access'

- by Son, Hyung Min Jan 22, 2026 08:22am

- As global pharmaceutical R&D trends rapidly shift toward high-priced anticancer and rare disease therapies, attention is focused on how the government's proposed drug pricing system reform will impact domestic patient access and the competitiveness of the pharmaceutical industry.On the 21st, Dailypharm held a Future Forum at the Catholic University of Korea's Songeui Campus Institute of Biomedical Industry. At the forum, Jaeho Jung, Head of Value and Access at Novartis, presented the perspective of multinational pharmaceutical companies on the proposed drug pricing reform.Jung said, “The reform plan is in line with global R&D trends. If appropriate value-based compensation and faster reimbursement listing are achieved, it will send a positive signal not only for patient access but also for Korea’s R&D ecosystem.”On the 21st, Dailypharm held its 55th Future Forum at the Catholic University of Korea's Songeui Campus Institute of Biomedical Industry.Development of high-cost anticancer drugs and rare disease treatments active... “Current drug pricing and reimbursement systems struggle to accommodate innovation.”Jung first highlighted the scale of clinical development in oncology and rare disease therapies. Currently, oncology accounts for 41% of all global clinical trials, of which 35% involve innovative drugs.The rare disease treatment market is expected to reach KRW 542 trillion by 2023, while rare cancer trials account for 74% of all ongoing rare disease studies.Despite this projected expansion of the high-cost new drug market, securing insurance coverage, which is a core value for patient access in Korea, remains inadequate. Among 460 new drugs approved in major countries from 2012 to 2021, the coverage rate averaged 28% across G20 nations and 29% in OECD countries, while Korea lagged at just 17%.Jung said, “Korea is facing a triple burden of ensuring universal welfare with limited resources, expanding access to new drugs, and guaranteeing patients’ right to treatment. The government has not been idle. The system has been continuously revised since 2007, but it has now reached its limits.”Examining the time required for reimbursement by treatment type, rare disease treatments took 23.6 months, anticancer drugs 31.6 months, and general new drugs 18.3 months. Even after new drug approval, a lengthy period remains before patients really gain reimbursement.At the same time, global R&D trends have driven the rise of antibody-drug conjugates (ADCs), bispecific antibodies, and biologics, many of which now hold multiple indications. Some immuno-oncology drugs have more than 20 approved indications.In response, the government has proposed reforms aimed at improving access to new drugs. These include an indication-based pricing, strengthening value-based drug reimbursement, and shortening the reimbursement listing period for rare diseases. In particular, the reimbursement listing period for rare disease therapies is expected to be reduced from an average of 240 days to within 100 days.Jung assessed, “With the proportion of high-cost new drugs rapidly increasing, it is difficult to guarantee patient access solely with limited national health insurance funds. As more drugs secure multiple indications, an indication-based pricing system is in line with global standards”He added, "The current system focuses on increasing reimbursement rates within the existing framework; it remains finance-centered from a patient access perspective. Although the government’s approach is understandable given budget constraints, the system must be operated with the patients in mind.”“Reform will create synergy, not suppress R&D”Jaeho Jung, Head of Value and Access at Novartis KoreaHe also expressed the view that the drug pricing reform could improve the domestic investment environment.Korean pharmaceutical companies, whose portfolios are largely centered on generics, have repeatedly voiced concerns that the proposed drug pricing reform could significantly stifle R&D.However, Jung emphasized the potential advantage that improved access to new drugs could expand investment by global pharmaceutical companies.He explained that currently, only two global pharmaceutical companies have production facilities in Korea, and attracting global-level R&D centers remains challenging.Jung stated, “Even when reviewing potential sites for our flagship one-shot treatment Kymriah, we received feedback that Korea was not suitable. If the system becomes more predictable and the value of R&D is properly recognized, direct investment and partnerships with Korean companies will expand.”He added, “If drug pricing improves in terms of value recognition and patient access, direct investment by global pharmaceutical companies will increase, as well as partnerships with Korean companies.”“Looking at Boston or New Jersey, which have rapidly emerged as global bioclusters, their R&D centers are well-established. This is because they are clustered together in terms of the collaborative R&D value. Looking at the domestic R&D environment, it feels like everyone is working hard, but individually. If the drug pricing reform system is well-established, I believe synergies will grow further, including joint R&D centers between global and domestic companies.”Furthermore, Jung pointed out that discussions on reimbursing high-value new drugs like ADCs and one-shot gene therapies have repeatedly faced difficulties within the existing framework. “The reform plan has a high potential to contribute to improving patient access, aligning with future global R&D trends.”Jung stated, “Operational execution is as crucial as the system's design. I hope a patient-centered system can take root through continuous dialogue between the government and industry.”

- Company

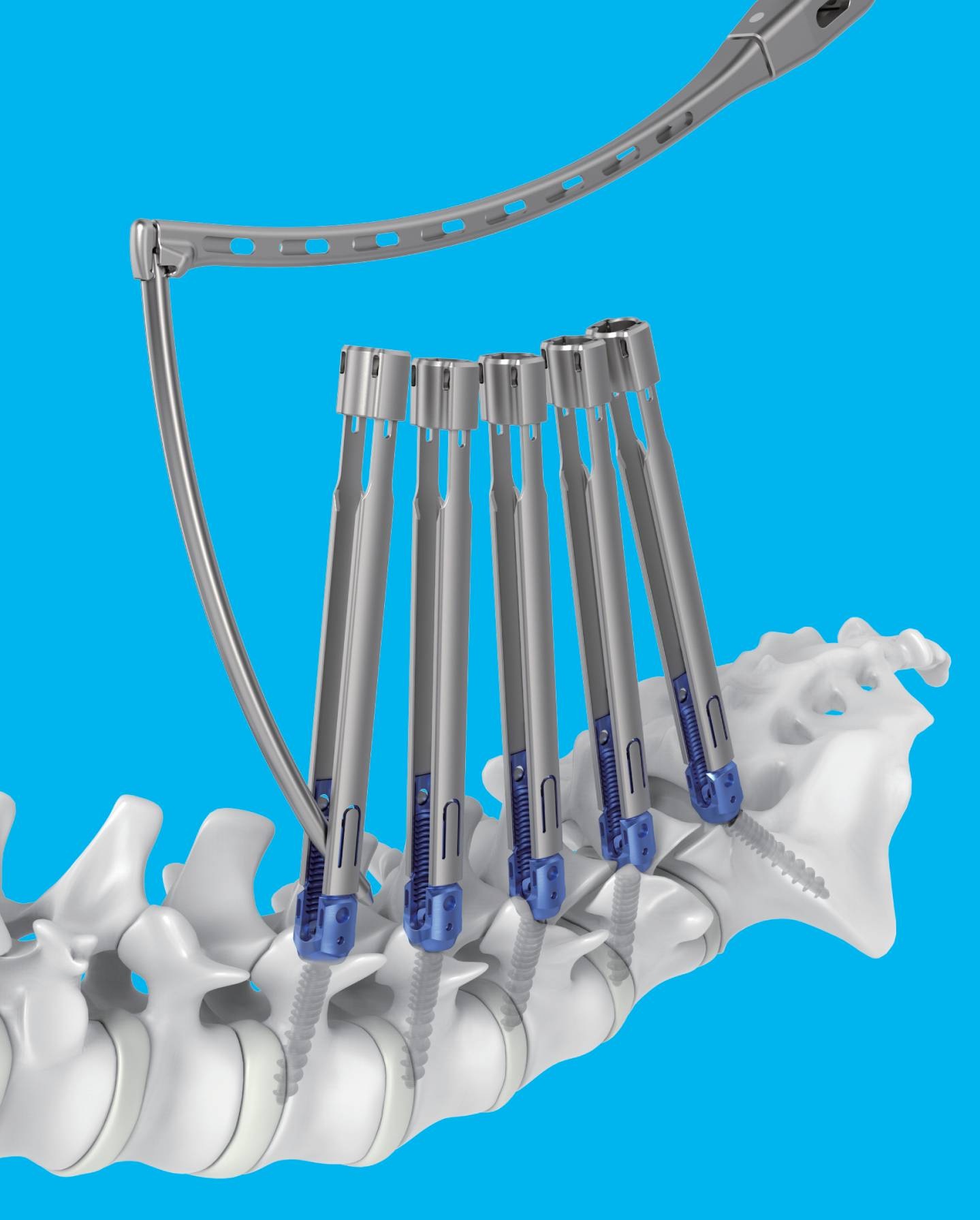

- Medtronic Korea launches new spine portfolio, Kanghui

- by Hwang, byoung woo Jan 22, 2026 08:22am

- 메드트로닉 신규 척추 포트폴리오 강휘Medtronic Korea (CEO Seung-rok Yoo) announced on the 21st that it has launched a new spine portfolio, “Kanghui,” aimed at expanding access to spine solutions.Kanghui is a new brand designed to deliver Medtronic’s accumulated technological expertise and quality management capabilities built across a broad range from the cervical spine to the lumbar spine at more affordable price points.With the introduction of Kanghui, Medtronic has established a comprehensive spine portfolio in Korea, ranging from standard models to premium models.The first product introduced within the Kanghui portfolio is the ‘ECO MIS’ system, an interbody fixation device.It consists of screws and rods in various shapes and lengths, along with fixation set screws, to provide patients with the appropriate size, shape, and design.It is used for minimally invasive surgery to stabilize and fixate the posterior thoracic, lumbar, or sacral spine in patients with unstable spinal fractures, spinal deformities (such as scoliosis), degenerative spinal disorders, spinal stenosis, degenerative disc disease (such as disc herniation), and segmental instability.Seung-rok Yoo, CEO of Medtronic Korea, said, “The introduction of Kanghui is part of a customized portfolio strategy reflecting the growing number of spinal disease patients in Korea and the expansion of specialized spine hospitals. Medtronic will continue to optimize and expand its portfolio to strengthen its competitiveness in the domestic spine market, while also contributing to the advancement of surgical techniques and the creation of a better treatment environment through partnerships with Korean medical professionals.”Meanwhile, the number of spinal disease patients in Korea increased by 9.1% over five years, from 8,912,158 in 2020 to 9,723,544 in 2024. The number of spinal surgery patients increased by 16.7% during the same period.Medtronic is a market leader with a total spine solution portfolio covering spinal disorders across the entire spine, from the cervical to the lumbar region.Through its extensive portfolio, which includes spinal fixation devices (Solera, Infinity, Zevo), minimally invasive spinal fixation systems (Sextant II, Longitude II), interbody fusion devices (Capstone, Clydesdale), and artificial discs (Prestige LP), it provides diverse minimally invasive treatment options.In addition, Medtronic integrates advanced technologies such as surgical navigation systems, contributing to improved surgical precision and enhanced patient safety.