- LOGIN

- MemberShip

- 2026-01-09 15:37:24

- Prescription drug approvals·BE testing slowing down

- by Chon, Seung-Hyun | translator | 2026-01-08 07:31:32

The entries of pharmaceutical companies into the prescription drug market continued to slow last year. Approval numbers for new products have dropped by more than 80% compared to six years ago, when generic approvals were at their peak. Creating new revenue streams has become increasingly difficult due to tightened regulatory hurdles, such as restrictions on joint development and the implementation of a tiered drug pricing system. The number of bioequivalence trial approvals related to generic development continues to decline. Concerns are arising that upcoming pricing reforms next year, which will lower generic prices further, may completely extinguish the drive for pharmaceutical companies to enter new markets.

Number of prescription drug approvals dropped 82% compared to 6 years ago...generic launch slowed down due to strengthened regulations of approvals and drug pricing

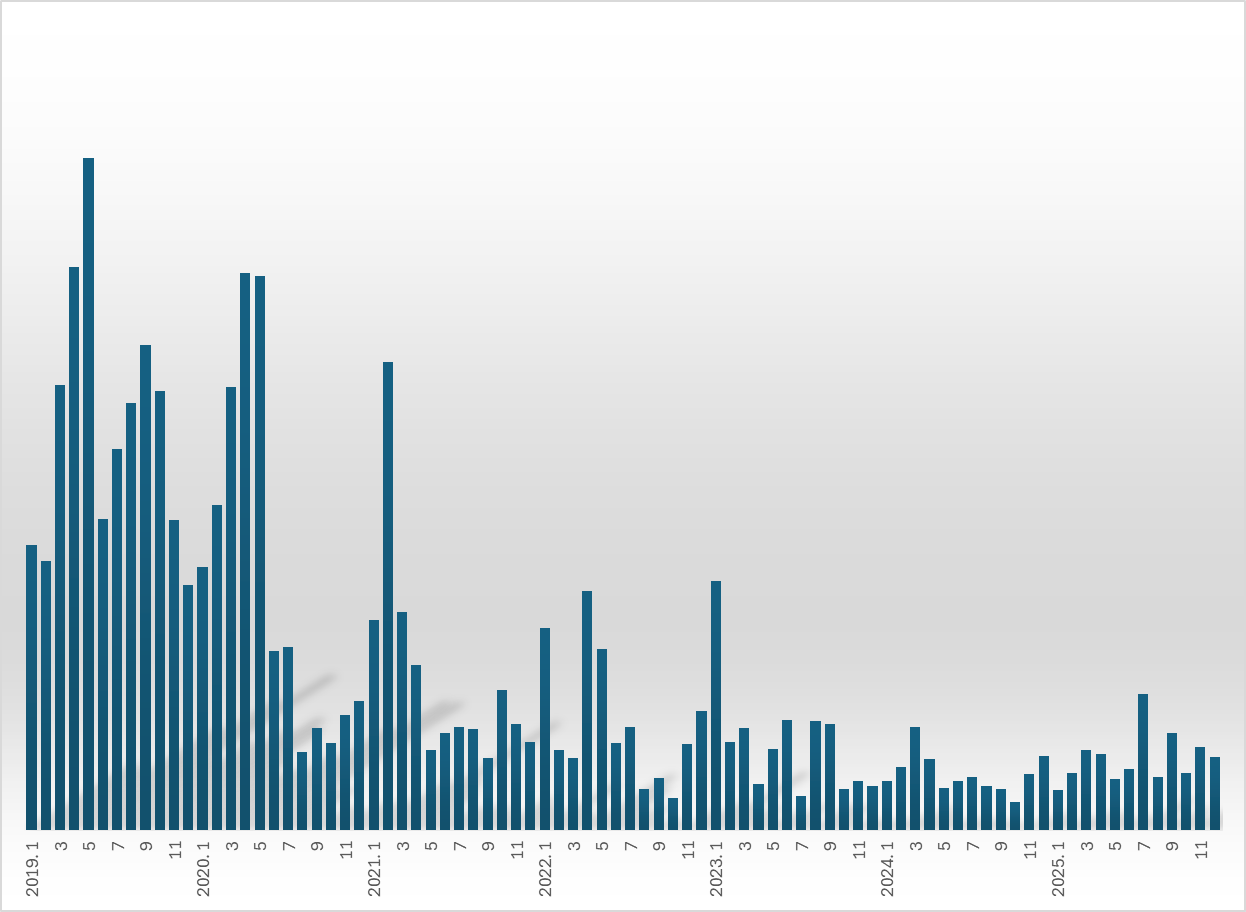

According to data released by the Ministry of Food and Drug Safety (MFDS) on January 6, 747 prescription drugs were approved last year. There is a 29% increase from the 579 approvals in 2024, but this is an 18% decrease compared to the 915 approvals in 2023.The number of prescription approvals dropped by 33% over the past three years, from 1,118 approvals recorded in 2022.

The downward trend has continued since approvals fell 38% from 4,195 in 2019 to 2,616 in 2020. Comparing last year's figures to 2019, the volume of prescription drug approvals has diminished by 82% in just six years.

Industry analysts believe this slowdown in new generic entries has become solidified due to shifts in pricing and approval systems.

Since July 2020, a tiered pricing system has been in implemented, where the ceiling price decreases the later a product is listed for reimbursement. If more than 20 generics of a specific ingredient are already listed, new entries can only receive a ceiling price as low as 85% of the existing lowest price. Furthermore, unless a pharmaceutical company develops the generic internally and conducts its own bioequivalence trials, the price drops significantly. This structure has led to a sharp decrease in approvals for generics that rely on contracted manufacturing.

Higher regulatory approval barriers have contributed to diminished drive to market entries. Following the implementation of reform to the Pharmaceutical Affairs Act in July 2021, the number of incrementally modified drugs and generics that can be approved based on a single clinical trial has been limited. The new regulation, the so-called '1+3' rule, limits the number of incrementally modified drugs and generics that can be approved based on a single clinical trial.

Specifically, a company that conducts its own trial can only share its data with three other products.

Previously, multiple companies could receive approval for 'consigned generics' using the same data set. This regulation effectively made it impossible for 'unlimited generic replication.'

The number of prescription drug approvals has shown robust growth since 2018, followed by a steady decline after 2020.

In 2018, 1,562 prescription drugs were approved, averaging 130 per month. This figure surged more than twofold in 2019 to 4,195 approvals, or an average of 350 per month. In May 2019 alone, the number of approvals reached 584.

From October 2018 to July 2020, over 100 prescription drugs were released every month. However, in August 2020, for the first time in 23 months, monthly approvals fell below 100. Following the approval of 216 items in January 2023, the monthly figure has remained below 100 for nearly three years, with the sole exception of July last year, when 118 approvals were recorded.

The surge in 2019 and 2020 was attributed by the government’s movement toward stricter regulations. In 2018, 175 hypertension treatments containing the active ingredient valsartan were banned due to excessive impurities. In response, the MOHW and the MFDS formed a 'consultative body to improve the generic drug system' and limit the oversaturation of generics.

As the government showed plans for these regulatory tightening measures, pharmaceutical companies moved ahead to secure generic product approvals, leading to a temporary spike. Since the actual implementation of these institutional reforms, the momentum for new market entries has slowed significantly.

Bioequivalence trial approvals down 61% from 4 years ago…diminished new entries of generics·underlying effects of drug pricing re-evaluation

Recent attempts to conduct bioequivalence trials for generic market entry have also stagnant.

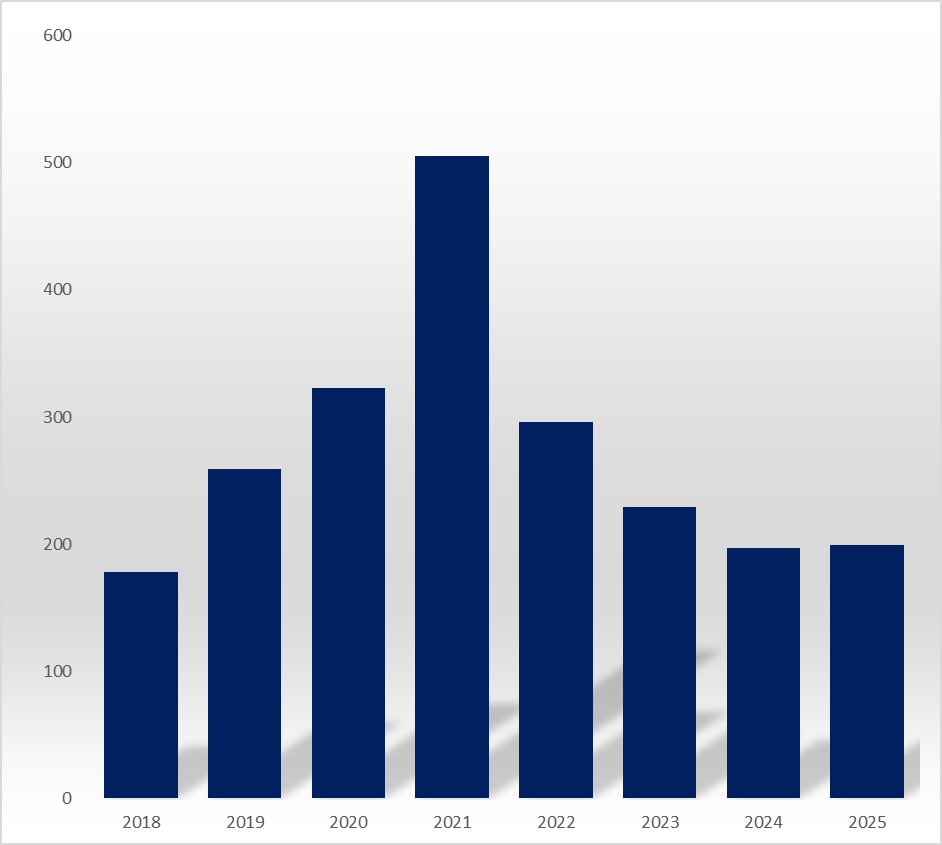

Last year, the number of bioequivalence trial plan approvals stood at 199, unchanged from 197 in 2023. This is a sharp decline from the 505 approvals recorded in 2021. Compared to four years ago, attempts at bioequivalence trials have decreased by 61%.

On the surface, new generic entry attempts by pharmaceutical companies have significantly decreased. Industry experts diagnose this as a result of a lack of major generic market openings and the loss of momentum for latecomers following the implementation of the tiered drug pricing system.

The recent decline also reflects an underlying effect from the conclusion of the government's generic price re-evaluation.

In June 2020, the Ministry of Health and Welfare (MOHW) announced a plan to re-evaluate pharmaceutical ceiling prices, maintaining existing prices only for generics that submitted proof of internal 'bioequivalence testing' and the use of 'registered drug master files (DMF)' by early 2023.

The generic drug price re-evaluation is a policy that applies the new pricing system, which took effect in July 2020, to previously listed generic products. Under the reformed system, a generic product can receive the maximum price only if it meets both criteria, outlining that the manufacturer must conduct its own bioequivalence trial and use registered drug master files (DMFs).

To avoid price cuts, pharmaceutical companies launched bioequivalence trials for generics that had already received approval. This strategy involved reformulating existing generics, conducting trials to prove equivalence, and obtaining modified approvals to maintain their current pricing. A common tactic was to switch from outsourced manufacturing to in-house production, thereby satisfying the 'conducted bioequivalence trial' requirement to evade price reductions.

Consequently, approvals for bioequivalence trial plans, which recorded at 259 in 2019, rose by 24.7% to 323 in 2020 following the announcement of the re-evaluation. By 2021, this number doubled to 505 cases in just two years.

Analysts suggest that with the conclusion of the price re-evaluation, the unusual phenomenon of conducting trials for already-approved generics has vanished, causing trial approval numbers to return to a downward trend.

Pharmaceutical companies have already experienced significant losses due to these re-evaluations. In September 2023, the first round of generic price re-evaluations resulted in price cuts of up to 28.6% for 7,355 items. In March 2024, a second round saw prices for 948 items drop by as much as 27.9%. Additional cuts were also imposed on newly categorized products that require equivalence testing, such as sterile preparations like injectables.

Pharmaceutical companies anticipate that another reform of the pricing system this year will further dampen market entry.

In the reform scheduled for this July, the calculation base for generic prices is expected to drop from 53.55% of the pre-patent-expiration price of the original drug to the 40% range, with 40%-45% as the most likely target. Mathematically, if the maximum generic price falls from 53.55% to 40%, it represents a 25% deterioration in profitability.

Entry barriers to late-stage generics are expected to rise as the government increases penalties for failing to meet maximum price requirements.

Under the July 2020 reform, a generic price is reduced by 15% for each criterion not met. If both are not met, the price is cut by 27.75%. Currently, failing one criterion drops the 53.55% base to 45.52%, and failing both drops it to 38.69%.

Under the upcoming reform, the reduction rate for failing a criterion will increase from 15% to 20%. If the new base is set at 45%, a generic failing one requirement will drop to 36%, and one failing both will fall to 28.8%. If the base is set at 40%, these figures drop further to 32.0% and 25.9%, respectively. In this scenario, a generic failing one requirement would see its price reduced by 20.9% compared to current levels. A generic failing two requirements would see its price reduced by 25.6%.

If the criteria are set to 40% , a generic that relies on contracted manufacturing without conducting its own bioequivalence trial would be capped at 32.0% of the original drug's pre-patent price. This is a 29.7% decrease from the current 45.52%. Compared to the era before the 2020 ceiling price requirements were introduced, generic prices would be cut by more than 40% (from 53.55% to 32.00%). For those failing both requirements, the cap would be 25.6%, a 33.8% drop from the current 38.69%.

The drive for latecomers to enter the market is expected to shrink further as the tiered pricing system is strengthened. The MOHW has proposed a plan to apply five percentage-point reductions, starting with the 11th generic entry of the same formulation, a significant tightening from the current 21st-entry regulation. Under the reformed system, this additional price cut measure will trigger much earlier, effectively lowering price standards across the entire generic sector.

-

- 0

댓글 운영방식은

댓글은 실명게재와 익명게재 방식이 있으며, 실명은 이름과 아이디가 노출됩니다. 익명은 필명으로 등록 가능하며, 대댓글은 익명으로 등록 가능합니다.

댓글 노출방식은

댓글 명예자문위원(팜-코니언-필기모양 아이콘)으로 위촉된 데일리팜 회원의 댓글은 ‘게시판형 보기’와 ’펼쳐보기형’ 리스트에서 항상 최상단에 노출됩니다. 새로운 댓글을 올리는 일반회원은 ‘게시판형’과 ‘펼쳐보기형’ 모두 팜코니언 회원이 쓴 댓글의 하단에 실시간 노출됩니다.

댓글의 삭제 기준은

다음의 경우 사전 통보없이 삭제하고 아이디 이용정지 또는 영구 가입제한이 될 수도 있습니다.

-

저작권·인격권 등 타인의 권리를 침해하는 경우

상용 프로그램의 등록과 게재, 배포를 안내하는 게시물

타인 또는 제3자의 저작권 및 기타 권리를 침해한 내용을 담은 게시물

-

근거 없는 비방·명예를 훼손하는 게시물

특정 이용자 및 개인에 대한 인신 공격적인 내용의 글 및 직접적인 욕설이 사용된 경우

특정 지역 및 종교간의 감정대립을 조장하는 내용

사실 확인이 안된 소문을 유포 시키는 경우

욕설과 비어, 속어를 담은 내용

정당법 및 공직선거법, 관계 법령에 저촉되는 경우(선관위 요청 시 즉시 삭제)

특정 지역이나 단체를 비하하는 경우

특정인의 명예를 훼손하여 해당인이 삭제를 요청하는 경우

특정인의 개인정보(주민등록번호, 전화, 상세주소 등)를 무단으로 게시하는 경우

타인의 ID 혹은 닉네임을 도용하는 경우

-

게시판 특성상 제한되는 내용

서비스 주제와 맞지 않는 내용의 글을 게재한 경우

동일 내용의 연속 게재 및 여러 기사에 중복 게재한 경우

부분적으로 변경하여 반복 게재하는 경우도 포함

제목과 관련 없는 내용의 게시물, 제목과 본문이 무관한 경우

돈벌기 및 직·간접 상업적 목적의 내용이 포함된 게시물

게시물 읽기 유도 등을 위해 내용과 무관한 제목을 사용한 경우

-

수사기관 등의 공식적인 요청이 있는 경우

-

기타사항

각 서비스의 필요성에 따라 미리 공지한 경우

기타 법률에 저촉되는 정보 게재를 목적으로 할 경우

기타 원만한 운영을 위해 운영자가 필요하다고 판단되는 내용

-

사실 관계 확인 후 삭제

저작권자로부터 허락받지 않은 내용을 무단 게재, 복제, 배포하는 경우

타인의 초상권을 침해하거나 개인정보를 유출하는 경우

당사에 제공한 이용자의 정보가 허위인 경우 (타인의 ID, 비밀번호 도용 등)

※이상의 내용중 일부 사항에 적용될 경우 이용약관 및 관련 법률에 의해 제재를 받으실 수도 있으며, 민·형사상 처벌을 받을 수도 있습니다.

※위에 명시되지 않은 내용이더라도 불법적인 내용으로 판단되거나 데일리팜 서비스에 바람직하지 않다고 판단되는 경우는 선 조치 이후 본 관리 기준을 수정 공시하겠습니다.

※기타 문의 사항은 데일리팜 운영자에게 연락주십시오. 메일 주소는 dailypharm@dailypharm.com입니다.