- LOGIN

- MemberShip

- 2025-12-21 02:52:46

- Policy

- Will the external reference pricing reevals gain momentum?

- by Lee, Jeong-Hwan Jul 18, 2025 06:35am

- Eun-Kyung Jeong, nominee for Minister of Health and Welfare, said that “it is important to manage drug prices at an appropriate level given the limited health insurance resources” regarding the post-marketing price review system to lower generic drug prices through “external reference pricing evaluations,” suggesting the possibility of its introduction upon her final appointment. Jeong also revealed plans to review policies such as improving the certification system for innovative pharmaceutical companies and expanding incentives to encourage pharmaceutical companies to invest in R&D for innovative new drugs. On the 17th, nominee Eun-Kyung Jeong revealed her position on the external reference pricing reevaluation system in written questions during her confirmation hearing with Representative Yoon Kim of the Democratic Party of Korea and Representative Jong-heon Baek of the People Power Party. Representative Yoon Kim pointed out that the external reference pricing reevaluation of generic drug prices, which the MOHW announced last year, has been postponed indefinitely, and raised the need for its prompt implementation. On the other hand, Representative Jong-heon Baek questioned the need to introduce a system to lower drug prices by comparing them with overseas prices, arguing that it is unreasonable to lower domestic generic drug prices solely based on drug prices overseas, given that each country's insurance system, drug price determination process, and level of social consensus differ. On this, Jeong replied, “The demand for drugs is constantly increasing due to the growing number of elderly people and patients with chronic disease. In order to provide optimal drug reimbursement with limited national health insurance finances, it is important to manage drug prices at an appropriate level.” Jeong explained, “We will carefully review the current status of domestic and international drug pricing systems and policy improvements, and consider acceptability by gathering opinions from the field to manage drug prices reasonably after listing. We will also actively gather opinions through regular communication with the pharmaceutical industry, relevant agencies, and experts on the direction of drug pricing system improvements.” Regarding measures to encourage R&D for innovative new drugs, Jeong said, “The pharmaceutical and biotechnology industry is a national strategic industry that can serve as Korea’s next growth engine, so it is time to scale it on a national level. To this end, we will strengthen compensation for the innovative value of new drugs and reform the compensation system to encourage R&D investment, thereby supporting the cultivation of pharmaceutical companies with global new drug development capabilities.” Jeong added, “We plan to improve the certification system for Korea Innovative Pharmaceutical Companies to encourage their R&D investment in innovative new drugs. We will also consider expanding incentives for companies that strengthen their R&D efforts.”

- Company

- Denmark's non-profit foundation's virtuous governance cycle

- by Jul 18, 2025 06:35am

- In 1922, Dr. August Krogh paid just $1 to introduce insulin production technology from the University of Toronto in Canada. At the time, he made two promises to the University of Toronto research team: to make insulin available to all patients at an affordable price and to use insulin for public healthcare rather than for commercial gain. And Leo Pharma delivered on this promise. Despite the uncertain profitability of insulin production, Leo Pharma participated in its production, laying the groundwork for the first commercialization of insulin in Northern Europe. Following this, Dr. Krogh established the non-profit organization Nordic Insulin Laboratory to ensure a stable supply of insulin. The two brother researchers who worked with him at the laboratory later spun off to form Novo Insulin Research Institute. The two organizations merged in 1989, giving rise to today's Novo Nordisk. Denmark's public-interest-driven medical philosophy did not end as a single generation’s promise. The spirit was carried forward through the corporate governance structure of foundation ownership. Major Danish pharmaceutical companies such as Novo Nordisk, Leo Pharma, and Lundbeck all have a structure in which a non-profit foundation serves as the top shareholder. These foundations support the long-term stability of the companies and return profits to society and science, thereby putting into practice the public values emphasized by Dr. Krogh even today. 'Foundation is the largest shareholder'... A sustainable management model created by society, institutions, and culture According to industry sources on the 15th, Denmark has the most structured ‘foundation-owned model’ in Europe. Approximately 1,300 companies in Denmark are operated as foundations. According to research by Børsting and Thomsen (2017), foundation-owned companies account for approximately 70% of the total market capitalization of the stock market in Denmark, demonstrating the overwhelming influence of foundation-owned companies. Pharmaceutical companies such as Novo Nordisk, Leo Pharma, and Lundbeck, as well as toy company Lego, beer company Carlsberg, and shipping company Maersk, all adopt a governance structure where a foundation is the majority shareholder. Novo Nordisk's governance structure is organized as a “foundation → holding company → operating company” structure. At the top is the non-profit public interest foundation Novo Nordisk Foundation, established with the goal of realizing corporate social responsibility and public value. Rather than directly managing the company, it owns Novo Holdings, a holding company and professional investment firm, as a 100% subsidiary. Novo Holdings, in turn, holds shares in major pharmaceutical companies such as Novo Nordisk and Novozymes. This structure effectively allows the foundation to control Novo Nordisk through Novo Holdings. Novo Holdings holds approximately 28% of Novo Nordisk's shares. Although the surface ownership ratio is relatively low, Novo Holdings secures approximately 77% of the total voting rights of Novo Nordisk through a dual-class share structure, enabling it to maintain stable management control. Under the dual-class share structure, the number of voting rights varies depending on the type of shares. The shares held by Novo Holdings are designed to allow the exercise of more voting rights per share than ordinary shares. Novo Holdings Ownership Structure (Source: Novo Holdings) Lundbeck is another publicly listed pharmaceutical company with a foundation-based governance structure. The Lundbeck Foundation is the largest shareholder, holding approximately 70% of Lundbeck's shares. Another pharmaceutical company, Leo Pharma, is approximately 80% owned by the Leo Foundation. The remaining shares of Leo Pharma are held by private equity fund Nordic Capital. Leo Pharma plans to go public as early as next year, with the Leo Foundation maintaining a majority stake even after the IPO. Denmark's foundation-based governance structure is different from Germany's family ownership and South Korea's holding company-based structures, as it is based on social values. In this structure, the foundation functions as the core entity that designs the company's direction and strategy, going beyond the role of the largest shareholder. The foundation prioritizes long-term research and development and the realization of social value, rather than being swayed by short-term profits. The foundation reinvests profits from dividends received from the company and its own investment activities into public welfare projects. The establishment of a foundation-based governance structure in Denmark is not simply due to the philosophy of founders or historical coincidence. It is a structural product of the interplay between social, economic, institutional, and cultural factors. Many Danish companies began as family businesses, but instead of passing on shares to their children, founders often chose to transfer them to public interest foundations. For example, the founder of Novo Nordisk, Dr. Krogh, did not pass on shares to his family even after the Nordic Insulin Laboratory grew into a corporation, instead transferring ownership to a public foundation. Leo Pharma, a company founded by a pharmacist who accumulated capital to grow the business, also passed on shares to a foundation rather than to his children, continuing the founding philosophy. Novo Nordisk Foundation, Lundbeck Foundation, Leo Pharma Foundation Denmark's characteristics as a small open economy also influenced the establishment of foundation-based governance structures. In Denmark, external capital inevitably held significant influence, leading to the natural adoption of foundation-based governance structures. Since foundations function as a means of defending corporate control, even if external parties attempt to suddenly acquire a large amount of shares or engage in hostile mergers and acquisitions (M&A), they cannot effectively seize control of management. Government policy support also played a crucial role in the establishment of a foundation-based governance structure. Under Danish law, companies owned by foundations are eligible for corporate tax exemptions if they distribute a certain percentage of their annual net profits for public welfare purposes. For example, if a foundation allocates more than 4% of its annual revenue to social welfare, it is exempt from taxation. This enables foundations to actively disburse subsidies and research funds. The legal framework enabling foundations to stably own companies is another core factor enabling public interest-centered management. Denmark restricts the easy sale of shares owned by foundations. This is to ensure that foundations are not swayed by short-term market fluctuations or external pressures, and can execute long-term corporate strategies in line with the founder's philosophy and public interest objectives. In other words, policy support has provided a foundation for the founders' philosophy to be institutionalized and sustainably implemented, rather than remaining a one-time legacy. Long-term perspective rather than short-term performance... Foundation-based governance proves with results The most distinctive feature of the Danish foundation-based governance structure is the clear separation of ownership and management and the simplicity of the structure itself. For example, the Novo Nordisk Foundation's board of directors consists of 11 members, including Chairman Lars Rebien Sørensen. Three of the board members are employee representatives. Employee representatives are elected by Novo Nordisk or Novonesis employees for a four-year term. It is also noteworthy that there are no issues of dual listing within the governance structure. In the Novo Nordisk model, the foundation controls the listed operating company through a non-listed holding company, creating a single stakeholder structure that minimizes the potential for conflicts of interest and external interference. This distinguishes it from the domestic model, where the holding company and operating company are listed separately, leading to recurring issues such as conflicts of interest between the holding company and subsidiary shareholders and allegations of profit diversion from subsidiaries. Jun-beom Cheon, Vice Chairman of the Korean Corporate Governance Forum (Attorney), explained, “The fact that the foundation holds 100% of the holding company's shares means that the holding company is unlisted. This structure allows for the continuous pursuit of business under the same interests without duplicate listings of the operating company.” Ultimately, the core is the “single governance structure without duplicate listings” formed around the foundation. This structure provides a foundation for companies to consistently execute long-term strategies without being overly concerned about short-term results. As they are relatively free from the short-term profit demands of external investors or shareholders, they can focus on tasks such as long-term research and development (R&D) or the realization of public value. Also, the foundation can demonstrate high flexibility in terms of equity ownership and investment methods. It can secure a majority stake to deeply engage in management or, conversely, hold a minority stake while focusing on long-term support and public interest objectives. Since the timing of investment exit is not strictly predetermined, it follows a distinctly different trajectory from private equity funds that pursue short-term exits based on the premise of achieving a certain level of returns. The most notable product of foundation-based governance is “Wegovy.” Thanks to an environment that enabled sustained R&D, Novo Nordisk has grown into the world's leading GLP-1 antidiabetic and obesity treatment company. Lundbeck and Leo Pharma are no exceptions. Thanks to their stable foundation-based governance structures, these companies have been able to maintain consistent strategies over the long term, even in low-profit or market-uncertain fields such as mental health treatments and rare/chronic skin disease therapies, despite incurring losses. Lan Ding, Vice President of Lundbeck, stated, “We have pursued a strategy focused solely on a specific disease group, neurological disorders, similar to Lundbeck. If a company has a structure where the foundation holds 70% of the shares, like Lundbeck, it can prioritize long-term value over short-term results.” Trend and portfolio of Novo Holdings The foundation is not bound by short-term performance, but it does not neglect profit generation. Last year, Novo Holdings earned 8 billion euros (approximately KRW 13 trillion), doubling its sales from the previous year. The portfolio return rate jumped from 9.4% in 2023 to 18% last year. This is the result of Novo Holdings' strategic investments based on its expertise in life sciences and its ability to connect ecosystems. Denmark Foundation returns profits to society... Attracting global talent through investment in basic sciences The Danish pharmaceutical company's foundation also plays the role of an investor in the national medical and basic science ecosystem. All profits generated by Novo Holdings are transferred to the foundation. As a 100% non-profit organization, the Novo Nordisk Foundation redistributes these funds in the form of grants for the benefit of society. This creates a cycle structure where corporate profits are reinvested through the foundation for public purposes such as science, health, and education. The Novo Nordisk Foundation executes public-interest investments across a wide range of fields, from promoting science, technology, engineering, and mathematics (STEM) education to vaccine development, infectious disease response, and AI supercomputing infrastructure construction. The foundation allocates an annual grant budget of USD 1 billion for these activities and plans to expand its investment to USD 2 billion over the next decade. Novo Nordisk Foundation These investments have strengthened the scientific base throughout Denmark and attracted top talent from around the world to the country. In fact, many scientists from around the world have flocked to major Danish universities such as the University of Copenhagen and the Technical University of Denmark, which in turn has led to an influx of talent to Danish biotech companies, including Novo Nordisk. A representative from Novo Holdings explained, “There was a shared awareness that without attracting overseas talent, both Novo Nordisk and Danish universities would struggle to maintain their current level of research capabilities. Through the Novo Nordisk Foundation and Novo Nordisk actively supporting research infrastructure centered in Copenhagen, we have created a virtuous cycle where talented researchers and professors from around the world are drawn to Denmark.” The foundation is also recognized as the hub of Denmark's bio-industry innovation ecosystem. This is because the foundation directly designed and led the structure that connects early-stage science and technology with entrepreneurship. The BioInnovation Institute (BII) is one representative example. BII is a non-profit startup support organization established with full funding from the Novo Nordisk Foundation. The BioInnovation Institute (BII), a world-class life science startup support organization based in Denmark, provides various dedicated spaces and infrastructure to nurture startups. BII provides up to NKR3 million (approximately KRW 600 million) in grants to early-stage technology-based startups without requiring equity. In addition, it operates a full-cycle support system that includes shared laboratory infrastructure, dedicated mentoring, investor connections, and business development strategy planning. Currently, BII accounts for about 80% of Denmark's life science and bio sectors, playing a central role in the overall bio ecosystem. Startups incubated by BII attract follow-up investments from Novo Holdings' venture funds and global investors. Some form strategic partnerships with Novo Nordisk and Leo Pharma. A BII representative stated, “To date, 80 companies that have received BII support have successfully secured external funding. For every 1 euro invested by BII, companies secure an average of 7 euros in additional grants or investments.” This virtuous cycle has solidified the foundation-based governance structure as the backbone connecting Denmark's bio industry ecosystem.

- Opinion

- [Reporter's View] Bio policy should remain consistent

- by Kim, Jin-Gu Jul 17, 2025 06:13am

- In November 2024, the Yoon Suk Yeol government officially announced the launch of the National Bio Committee. The government aimed to operate a 'presidential' governance body in a preparatory response to the global bioeconomy era. Considering that the previously established 'Bio-health Innovative Committee' was chaired by the Prime Minister, the National Bio Committee was regarded as an advancement in terms of its rank and role. The establishment of a governance body overseeing the pharmaceutical and biotech industries, directly under the President, has long been a goal of the pharmaceutical and biotech industries. Previously, the pharmaceutical and biotech industry operated with separate development strategies fragmented across different divisions. The wall between regulations and support policies, as well as the lack of a central coordinating point for strategic discussions, had been a long-standing concern for the industry. When the government took an initiative to 'unify policies scattered across divisions and manage them,' the industry welcomed it with open arms. There was great anticipation that a policy control tower would enable coordination of regulatory improvements, industrial support, and technological development at a governmental level. However, just about a month after the committee's launch plan was announced, a state of emergency was declared, followed by martial law. A continuous political chaos followed this. Former President Yoon Suk Yeol faced an impeachment trial. Ultimately, the Constitutional Court of Kora upheld his impeachment. Following an early presidential election, President Lee Jae Myung took office on May 4th last month. Even during the political turmoil, the National Bio Committee carried out two official schedules. At its launch ceremony in January this year, the committee unveiled the "Republic of Korea Bio Grand Transformation Strategy." In its second meeting in May, it selected 10 key R&D areas, including AI-driven drug discovery·radiopharmaceuticals·gene therapies, and discussed development strategies. However, there was insufficient time to yield accomplishments. With the new administration taking power, the committee's existence became uncertain. As an organization established by presidential decree, it is not an independent body under law. It lacks authority in terms of organization, budget, and personnel. In other words, it can be abolished at any time with the new government. It is not uncommon for presidential committees to be abolished with the new administration. New governments often introduce new slogans, and various committees have also disappeared with changes in power. Will the National Bio Committee follow the same path? This is a point of concern for the industry. Given that the pharmaceutical and biotech industry development strategies proposed by the National Bio Committee were recognized for their industrial validity regardless of the administration, the potential disappearance of this newly launched committee is frustrating. In the biotech industry, sustainability is more important than speed. It typically takes over 10 years to develop a new drug and bring it to the global market. This industry operates on a different timeline than a government's five-year term. If industrial strategies are reset every time the government changes, it will be difficult for the Korean pharmaceutical and biotech industry to advance its global competitiveness. Even if the government changes, the core axis of industrial strategy must be maintained. The direction of breaking down walls between ministries and consolidating public and private capabilities should not disappear. Even if a committee is renamed, its symbolism and status as a direct presidential committee should be preserved.

- Company

- Pharmaceutical exports to U.S. have surged by 46%

- by Kim, Jin-Gu Jul 17, 2025 06:13am

- Korea-made pharmaceutical exports to the United States have surged. In the first half of this year, exports to the U.S. amounted to approximately KRW 1.53 trillion, a 46% increase compared to the same period last year. Notably, exports to the U.S. saw an exceptional surge in June. The export in June alone was almost the total of the preceding four months. This surge is interpreted as a precautionary measure to prepare for the potential impact of pharmaceutical tariffs. Korean pharmaceutical and biotech companies are preparing for tariff shocks by pre-stocking inventory in the U.S. Driven by increased exports to the U.S., South Korea's pharmaceutical export performance has broken previous records. In the first half, Korea-made pharmaceutical exports reached KRW 6.38 trillion, a 29% year-on-year (YoY) increase. Exports to U.S. surged… June alone accounts for half of total pharmaceutical exports According to the Korea Customs Service on July 17, South Korea's pharmaceutical exports to the U.S. in the first half of this year amounted to USD 1.11051 billion (approximately KRW 1.53 trillion). This is a 46% increase compared to USD 758.43 million in the first half of last year. Pharmaceutical export sales to U.S. over the past two years (unit: USD 1 million, source: Korea Customs Service; dotted boxes show an increase from USD 758.43 million in 2024 to USD 1.11051 billion in 2025) Exports notably surged in June. Exports to the U.S. in a single month reached USD 458.38 million (approximately KRW 630 billion). This volume is equivalent to the export performance of the preceding four months (USD 475.82 million). The proportion of total pharmaceutical export performance accounted for by the U.S. also significantly expanded in June. Until then, the monthly share of exports to U.S. had been limited to 18% for two years, but it soared to 49% in June. This means nearly half of all pharmaceutical exports in June went to the U.S. Are they preparing for pharmaceutical tariff shock?… Enhanced stockpiling movement in the U.S. The pharmaceutical industry attributes the surge in pharmaceutical exports to the U.S. to the potential pharmaceutical tariffs by the U.S. government. U.S. President Donald Trump recently stated in a cabinet meeting that tariff of up to 200% could be imposed on imported pharmaceuticals. He estimated the tariff imposition timeline to be "1 to 1.5 years from now." Specific tariff rates and targeted items are expected to be announced by the end of this month. U.S. Commerce Secretary Howard Lutnick said, "Whether tariffs will be imposed on the pharmaceutical and semiconductor sectors will be determined after the investigation under Section 232 of the Trade Expansion Act concludes at the end of this month." Section 232 of the Trade Expansion Act details the Commerce Department to investigate the impact of imports on national security and enables the President to take responsive action. The U.S. government initiated an investigation related to this in April. Korean pharmaceutical and biotech companies have begun proactive responses. Notably, their response efforts are reported to have intensified since the U.S. government initiated the Section 232 investigation in April. A strategy of pre-exporting pharmaceuticals to U.S. local entities is being employed to stockpile inventory. For example, Celltrion plans to secure and maintain a two-year inventory in the U.S. in the short term. Separately, it has moved to secure a production base in the U.S., having signed contracts for local contract manufacturing (CMO) of products sold in the U.S., and is also considering acquiring companies with U.S. production facilities. Other companies with a significant share of exports to U.S. are also reported to have prepared similar strategies. An analysis suggests that the short-term surge in exports to U.S. is due to intensified efforts by these companies to stockpile local inventory. Pharmaceutical exports totaled USD 4.62 billion in the first half of the year… 29% increase YoY The expansion of exports to U.S. has driven the increase in overall pharmaceutical export performance. In the first half of this year, South Korea's pharmaceutical exports amounted to USD 4.6166 billion (approximately KRW 6.38 trillion). This is a 29% increase compared to USD 3.57795 billion in the first half of last year. This is the highest record for a half-year period. The previous record was USD 4.21219 billion in the second half of 2021. That period was most heavily influenced by the COVID-19 pandemic, with special demand, as exports surged with the full export of domestically produced COVID-19 vaccines. After that, exports returned to previous levels. Although there was a steady increase every half-year, half-yearly figures had never exceeded USD 4 billion until now. Half-yearly pharmaceutical performance changes (unit: USD 1 million, source: Korea Customs Service) Pharmaceutical imports saw a slight increase from USD 4.45176 billion in the first half of last year to USD 4.6166 billion in the first half of this year. With exports increasing significantly and imports remaining at previous levels, the pharmaceutical trade balance has improved substantially. In the first half, the pharmaceutical trade balance recorded a surplus of USD 419.62 million. Previously, the only half-yearly pharmaceutical trade balance surplus was in the second half of 2020 (a surplus of USD 86.11 million).

- Policy

- When will Keytruda’s reimb be reviewed by DREC?

- by Lee, Tak-Sun Jul 17, 2025 06:13am

- Attention is focused on when Keytruda, for which reimbursement standards were set for 11 indications in February, will be submitted to the Drug Reimbursement Evaluation Committee (DREC) for review. This is because, although the reimbursement standards were established by the Health Insurance Review and Assessment Service's Cancer Review Committee, the barrier of DREC remains. According to industry sources on the 15th, HIRA is currently evaluating the estimated additional claims for Keytruda. This process is conducted to decide whether to apply the preliminary drug price reduction system for drugs with an expanded scope of use. The preliminary drug price reduction system for drugs with expanded scope of use is a system designed to quickly increase patient access to treatment by omitting cost-effectiveness evaluations. It applies a pre-determined reduction rate to reduce the insurance price ceiling for drugs by up to 5% in consideration of the estimated additional claims resulting from the expansion of reimbursement criteria. However, this system is applied only when the expected claims amount is between KRW 1.5 billion and KRW 10 billion. If the expected claim amount exceeds KRW 10 billion, the drug price is adjusted through negotiations between the National Health Insurance Service regarding the expansion of the drug's approved indications. In February, the National Health Insurance Service set reimbursement criteria for 11 additional indications for Keytruda. MSD requested reimbursement expansion in 2023, and after 5 attempts, the expansion was finally approved by the National Health Insurance Service on the company’s 6th attempt. At that time, the reimbursement criteria were set for stomach cancer, esophageal cancer, endometrial cancer, colorectal cancer, squamous cell carcinoma, cervical cancer, breast cancer, small intestine cancer, and bile duct cancer. After setting the reimbursement criteria, HIRA reported it to the MOHW. After review, MOHW requested HIRA to review the preliminary drug price reduction for drugs with an expanded scope of use. It is expected to take some time before the application can be submitted for DREC review, as the relevant work must be completed first. Some predict that it will be difficult for the matter to be submitted to the DREC even in August. This is because the analysis of the expected claims amount will take a long time due to the large number of indications, and the pharmaceutical companies must also go through the process of accepting the preliminary drug price reduction. Even if it passes DREC review, negotiations with the National Health Insurance Service remain, and it is uncertain whether its reimbursement will be granted and listed within the year. Due to the complicated reimbursement process, some in the industry believe that the introduction of indication-specific pricing should be considered. However, health authorities remain cautious about introducing such a system. Whichever the cause, the patients are likely to face a long wait. However, it is a positive sign that HIRA recently added 12 indications for Keytruda to the partial reimbursement list as part of anticancer combination therapies, reducing the financial burden on patients. With the partial reimbursement, the other therapies included in the combination, excluding Keytruda, are covered by health insurance.

- Company

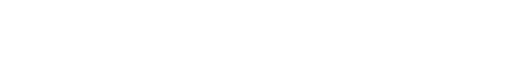

- How Denmark gave birth to the golden goose Wegovy

- by Cha, Jihyun Jul 17, 2025 06:13am

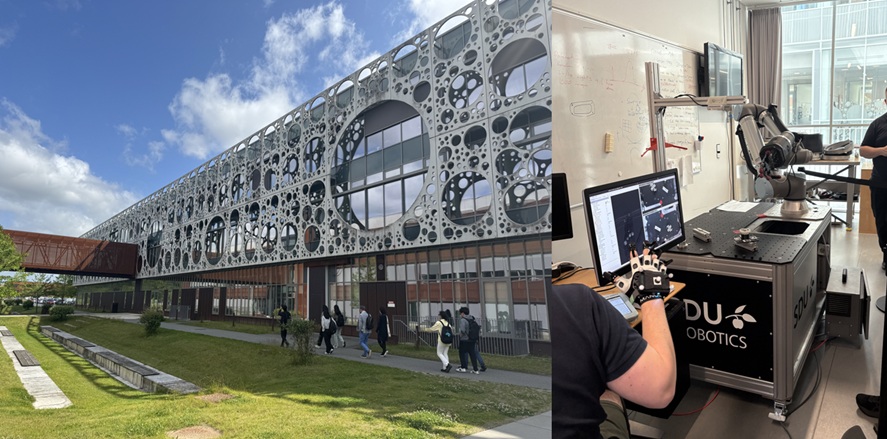

- Novo Nordisk, the Danish company that developed the obesity treatment Wegovy that shook the world, rose to the top in Europe in terms of market capitalization in 2023. It surpassed France's luxury goods group LVMH, which had held the top spot in the European stock market for over two years. At the time, Novo Nordisk’s market value was approximately KRW 790 trillion. This surpasses Denmark's gross domestic product (GDP) last year. It is truly a case of “one well-developed new drug” sustaining the country. Novo Nordisk is based in Denmark. Denmark has a population of 6 million and a land area only half that of Korea, but its biotechnology is considered among the best in Europe. The foundation of this technological prowess is Medicon Valley. Medicon Valley, located between Copenhagen and Malmö in Sweden, is the largest life science hub in Northern Europe. It is recognized as a model example of a biotech cluster where research and development infrastructure, capital, and talent are closely interconnected. Medicon Valley, a Nordic bio ecosystem that operates as one across borders According to industry sources on the 14th, Medicon Valley is the largest bio cluster in Northern Europe, covering the Copenhagen metropolitan area in Denmark and the Skåne region in Sweden. Denmark and Sweden have built a joint life science ecosystem centered on the Øresund Strait. It began to take shape in earnest in the mid-1990s, with Copenhagen, Lund, and Malmö serving as its core hubs. Medicon Valley's strength lies in its clustering effect. Industry, academia, medicine, and capital are concentrated within a single ecosystem, and they are organically connected to accelerate innovation. The core players in the bio ecosystem are physically close to each other and operate a system that promotes organic cooperation. One of the biggest factors supporting Medicon Valley's competitiveness is its high concentration of companies. There are more than 500 life science companies in the area. Many of them are global pharmaceutical companies or promising biotech companies. From leading global biopharmaceutical companies such as Novo Nordisk, Lundbeck, and LEO Pharma to startups rapidly growing in areas such as AI-driven drug discovery, antibody and cell therapies, and digital health, a diverse range of companies are concentrated in the region. Leo Pharma headquarters in Ballerup, Denmark, and Novo Holdings headquarters near Copenhagen city center The concentration of these companies brought qualitative synergies that go beyond mere quantity. When companies of different sizes and at different stages of development are physically close to each other, technological collaboration, talent circulation, information sharing, and business commercialization naturally occur. This enables innovation at a speed, efficiency, and scale that cannot be achieved by a single company or research institute alone. The dense structure of Medicon Valley goes beyond a simple locational advantage to serve as a foundation for collective intelligence that boosts the efficiency and speed of the entire bio industry. The academic and hospital infrastructure of the Danish bio cluster serves as the driving force behind the ecosystem. Medicon Valley is home to universities with some of the best research capabilities in Europe. The University of Copenhagen, the Technical University of Denmark, the University of Southern Denmark, and Lund University in Sweden are located within the cluster. These universities are not just educational institutions, but also core technology providers and launchpads for startups and industrialization in the bio ecosystem. Distribution of universities and research institutions in Medicon Valley (Source: Medicon Valley Alliance, MVA) Hospitals are the gateway to the Medicon Valley ecosystem. They are essential spaces for refining technologies developed at universities for practical application in patients and serve as trusted clinical validation partners for companies. In addition to Odense University Hospital, one of Denmark's three major university hospitals, and Rigshospitalet, a national central hospital, there are many university hospitals and regional hospitals specialized in clinical research, joint research, and technology validation. Most hospitals in Medicon Valley are directly connected to universities, enabling them to perform educational, research, and treatment functions simultaneously. In particular, it is common for biotech and medical device companies to test their initial technologies in hospital testbeds and then improve and commercialize them based on real-world data. A national clinical support system organically connects the hospital network, enabling the entire process, from clinical trial approval procedures to subject recruitment and data analysis, to proceed efficiently. National University of Southern Denmark, located in Odense, Denmark The collaboration between the University of Southern Denmark and Odense University Hospital is cited as an ideal model of industry-academia-hospital collaboration. Among these, SDU Robotics is a representative example of field-oriented medical innovation where technology development is directly applied to clinical settings. SDU Robotics is a robotics research center affiliated with the School of Engineering at the University of Southern Denmark, and companies such as Universal Robots (a collaborative robot developer) and MiR (an autonomous mobile robot company) were established through this center. The University of Southern Denmark and Odense University Hospital jointly operate multiple research centers. These institutions are physically located just 4 km apart, enabling them to swiftly coordinate the entire process from technology development to clinical validation. The two institutions collaborate on research and productization based on a 50:50 partnership, with developed technologies tested directly within the hospital and systematically validated for commercial viability. Thiusius Rajeeth Savarimuthu, Professor and Head of SDU Robotics, stated, “The ability of SDU Robotics to transition research outcomes into actual clinical applications is thanks to the collaboration between researchers with expertise in engineering and medicine. This collaboration has been further strengthened with the official launch of a joint research center between the university hospital and SDU's School of Engineering.” #Money flows even without government funding…The technology commercialization formula of Medicon Valley In Medicon Valley, technology does not end in the laboratory. Ideas invented at universities and hospitals are quickly turned into biotech, and then supported by a professional startup support platform and private funding system. The BioInnovation Institute (BII) is one representative institution. BII is a non-profit startup support organization fully funded by the Novo Nordisk Foundation. BII provides grants of up to 3 million kroner (approximately KRW 6 billion) to early-stage technology-based startups without requiring equity. Additionally, it operates a comprehensive support system covering shared experimental infrastructure, dedicated mentoring, investor connections, and business development strategy formulation. In fact, BII is attracting promising technology startup teams not only from Denmark but from all across Europe. To date, BII has produced over 100 startups, which have secured follow-on investments exceeding 500 million euros (approximately KRW 70 billion). Unlike many countries, including South Korea, where biotech startups still rely on government R&D projects or one-time grants, the BII model is unique in that it is led by the private sector and forms a cycle of startups and industrialization. Pic of BioInnovation Institute (BII) Another major strength of Medicon Valley is the establishment of a private-sector-led continuous investment ladder. The Novo Nordisk Foundation is Europe's largest foundation supporting the life sciences sector, with annual funding exceeding KRW 1 trillion. The foundation provides Proof of Concept (PoC) funding not only to BII but also to researchers at major universities such as the University of Copenhagen, the Technical University of Denmark, and the University of Southern Denmark. In subsequent stages, top European biotech venture capital firms such as Sofinnova Partners, Life Sciences Partners (LSP), and Novo Holdings continue to invest in companies spun out of BII or technology-based companies within Medicon Valley, from Series A to Series C. The process from incubation to technology verification to initial investment to follow-up VC is designed within a single ecosystem, providing a foundation for biotech companies to grow without any funding gaps. Ultimately, the core of Medicon Valley lies in the fact that each entity does not act independently. Technology is born in laboratories, verified in hospitals, commercialized by companies, and provided with growth momentum by private capital, all within a single cluster. For example, when cell therapy technology developed at the University of Copenhagen enters early clinical trials through joint research with a hospital, nearby biotech companies jointly develop or acquire the technology to promote its commercialization. During this process, the Novo Nordisk Foundation or BII provides initial funding, and venture capitalists follow up with subsequent investments if the technology shows promise. Distribution of major life science companies in Medicon Valley (Source: Medicon Valley Alliance·MVA) The physical proximity of industry, academia, hospitals, and capital is also a key factor enabling the cluster to function organically. Hospitals, universities, and companies are located within 30 minutes to an hour of each other. The Novo Nordisk headquarters is located in Bagsvaerd, approximately 15 km from the center of Copenhagen, Lundbeck is in the Østerbro district of Copenhagen, and Leo Pharma is in nearby Valby. The distance between these companies is within a 20-30 minute drive, and they are also within a 30-minute commute from universities and hospitals. This proximity enables the entire process from startup to commercialization, including technical reviews, clinical discussions, and investor meetings, to be completed within a single day. This goes beyond mere physical density, serving as a decisive factor in enhancing the intensity and speed of collaboration. Since technology, people, and capital can respond and circulate quickly within the same living area, the commercialization cycle of technology is shortened, and the execution power of innovation is enhanced. Medicon Valley also leads the way in securing high-level talent in the biotechnology and medical fields. With top European universities specializing in life sciences and medicine concentrated within the cluster, a steady stream of highly skilled professionals is produced across various fields, from basic science to biomedical engineering, healthcare, and AI-driven biotechnology. Additionally, companies, hospitals, and university research labs are closely connected, allowing talent to freely move between different institutions and organizations to accumulate practical experience. This talent circulation structure within the ecosystem facilitates the recruitment of specialized personnel and short-term project-based hiring within institutions, thereby enhancing their R&D agility and efficiency. Reducing regulations and speeding up approvals...The government's framework for bio innovation The Danish government's active policy support also plays an important role in the rapid functioning of the Medicon Valley ecosystem. The Danish government launched a public-private strategic group (Life Science Growth Team) and began implementing a life science growth strategy to foster the bio industry, a key growth engine for the country. This organization subsequently led to the establishment of a national life science strategy and the Life Science Office, which is directly under the Prime Minister's Office. The Life Science Office coordinates policies across all ministries, including health, education, industry, and foreign affairs, and serves as a government control tower overseeing the entire cycle from research and development to clinical trials and commercialization. The Danish government has also been actively recruiting global talent. It operates a fast-track visa system for highly skilled personnel in the life science field and provides support for foreign researchers to settle in Denmark, creating an environment that naturally attracts doctoral and master's degree researchers from around the world. In addition, it is expanding English-based higher education programs and international joint research projects, providing an open research ecosystem for researchers from countries outside Europe. Danish Medicines Agency introduces a fast-track system for early-stage clinical trials (Source: Korea Bio Association) Recently, the Danish Medicines Agency announced plans to introduce a fast-track review system for initial early-stage trial applications, with decisions on approval to be made within two weeks starting next month. The Danish Medicines Agency will collaborate with the Medical Research Ethics Committee (MREC) to notify applicants of approval decisions for all single-country Phase I and Phase I/II clinical trial applications within 14 days. This measure is part of the 2030 Danish Life Science Strategy. The 2030 Danish Life Science Strategy is a blueprint for the development of the bio industry announced by the Danish government at the end of last year, which includes comprehensive policy measures to make Denmark a leading life science powerhouse in Europe by 2030. Denmark plans to lower the barriers to clinical trials for biotech startups and global pharmaceutical companies and enhance the competitiveness of its research environment to boost the overall capabilities of the industrial ecosystem. In addition to shortening the clinical approval process, Denmark is laying the groundwork for various institutional measures to strengthen the competitiveness of the biotech industry. Denmark has already introduced a national pilot program to jointly evaluate research combining pharmaceuticals and medical devices. This program is an attempt to reduce institutional gaps in the approval process for combination products that combine pharmaceutical and medical devices. The country will also expand the use of AI and machine learning-based data analysis in clinical trials. By utilizing new technologies in clinical design and patient response prediction, Denmark plans to accelerate the development of personalized pharmaceuticals by upgrading relevant laws and technical systems by 2025.

- Company

- Oral lung cancer drug market race

- by Son, Hyung Min Jul 16, 2025 06:10am

- Late entrants, such as Leclaza and Lorviqua, are expanding their presence in the Korean lung cancer targeted therapy market, continuing rapid growth. While prescription sales for some EGFR and ALK-positive non-small cell lung cancer (NSCLC) treatments are stagnating or declining, newer drugs in these categories are showing a clear upward trend, driven by expanded reimbursement or additional indications. 3rd-generation targeted therapies for first-line treatment…distinct growth trend According to market research firm UBIST, on July 16, Leclaza's Q2 outpatient prescription sales reached KRW 20.6 billion, a 92.5% year-over-year (YoY) increase. This marks the first time Leclaza's quarterly prescription sales have surpassed KRW 20 billion. Leclaza is a 3rd-generation tyrosine kinase inhibitor (TKI) developed by Yuhan Corp. EGFR-positive lung cancer treatments are categorized into: first-generation drugs with AstraZeneca's Iressa (gefitinib) and Roche's Tarceva (erlotinib); second-generation with Boehringer Ingelheim's Giotrif (afatinib) and Pfizer's Vizimpro (dacomitinib); and third-generation with Leclaza (lazertinib) and Tagrisso (osimertinib). All of these are oral treatment options. Given their oral formulation, outpatient prescriptions are possible. However, considering inpatient prescription sales (which include prescriptions for hospitalized patients), their actual prescription volume is estimated to be even larger. Prescription sales of EGFR-positive lung cancer treatments (unit: KRW 100 million, source: UBIST). Dark Blue-Iressa (gefitinib), Orange-Tarceva (erlotinib), Yellow-Giotrif (afatinib), Gray-Vizimpro (dacomitinib), Sky Blue-Leclaza (lazertinib), Green-Tagrisso (osimertinib). Leclaza, approved in Korea in January 2021, was officially launched into the market with reimbursement coverage in the same year. Leclaza secured KRW 4.1 billion in prescription sales in just two quarters, recorded KRW 17.4 billion the following year, and successfully surpassed KRW 40 billion last year. Leclaza's outpatient prescription sales in the first half of the year alone reached KRW 38.2 billion, nearing its full-year prescription sales for 2024. Analysis suggests that Leclaza's increase in prescription sales is attributed to its approval as a first-line treatment for EGFR-positive lung cancer in July 2023. Previously, for patients to use Leclaza with reimbursement, they needed to have T790M positivity confirmed through a re-biopsy after using first- or second-generation TKIs. With Leclaza, Tagrisso, and other third-generation TKIs now covered as first-line treatments starting this year, the range of choices for medical professionals and patients has expanded to include the entire spectrum of first- to third-generation targeted therapies. Another strength of Leclaza is its potential for combination with Rybrevant. Recently, combination therapies such as Tagrisso + platinum-based chemotherapy and Rybrevant + platinum-based chemotherapy have obtained approval from overseas regulatory agencies as first-line treatments for lung cancer. Leclaza, which targets EGFR mutations in exons 19 and 21, and Rybrevant, which targets exon 20, are attracting attention as a combination of targeted therapies. Currently, the Leclaza + Rybrevant combination therapy is approved as a first-line treatment for lung cancer in Korea, the U.S., Europe, and Japan. AstraZeneca's Tagrisso maintains its market leadership. Tagrisso's Q2 prescription sales were KRW 47.3 billion, a 46.4% increase from the same period last year. Tagrisso's Q1 prescription sales increased by 53.7% year-on-year to KRW 43 billion, and its Q2 sales expanded by 46.4% to KRW 47.3 billion. Tagrisso is the only TKI that can be used in patients with early-stage lung cancer. In February 2021, Tagrisso was approved in Korea for adjuvant treatment after complete tumor resection in EGFR exon 19 and exon 21 mutated non-small cell lung cancer patients. In the Phase 3 ADAURA study, the Tagrisso treatment group showed a 51% reduction in the risk of death compared to conventional treatment. During the same period, the growth of first·second-generation TKIs stagnated. Among them, Boehringer Ingelheim's Giotrif had the highest prescription sales. Giotrif recorded KRW 2.9 billion in outpatient prescription sales in Q2 2025, maintaining the highest performance among first and second-generation drugs. However, its quarterly prescription sales have consistently decreased from KRW 5.2 billion in Q1 2023, falling by half in just over a year. Iressa also showed a downward trend during the same period, falling from KRW 4.5 billion to KRW 2.1 billion. Tarceva's prescription volume decreased to KRW 700 million, and Vizimpro's to KRW 100 million in Q2 last year. The establishment of third-generation targeted therapies as first-line options contributed to the decline in their prescription sales. ALK market also shifting…Lorviqua chases Following the EGFR treatment market, the ALK-positive NSCLC treatment market is also showing signs of change. A generational shift is underway, with second-generation drugs performing well and third-generation treatments expanding their reach. The market leader in this segment is Alecensa. Alecensa's Q2 prescription sales reached KRW 8.4 billion, representing an 18.3% year-over-year increase. Alecensa has shown steady growth since its prescription sales surpassed KRW 5 billion in Q3 2020. This treatment has maintained an average quarterly prescription sales of over KRW 8 billion since 2021. Prescription sales of ALK-positive NSCLC treatment market by quarters (unit: KRW 100 million, source: UBIST). Blue-Xalkori, Gray-Alecensa, Orange-Alunbrig, Yellow-Lorviqua. Alecensa is a second-generation ALK-positive targeted therapy developed by Roche. Targeted therapies used for ALK-positive lung cancer are categorized into three generations: first-generation, represented by Pfizer's Xalkori; second-generation, including Alecensa and Takeda's Alunbrig; and third-generation, represented by Pfizer's Lorviqua. Alecensa's increasing potential for use in early-stage lung cancer patients has given it the green light to maintain its market-leading position. According to clinical data disclosed at the European Society for Medical Oncology (ESMO 2023) annual meeting, Alecensa showed effectiveness in adjuvant chemotherapy after surgery. Alecensa successfully added the early-stage lung cancer indication in Korea in September of last year. Pfizer's Lorviqua recorded KRW 4.3 billion in Q2 prescription sales, a 53.6% increase year-on-year. Lorbrenda's quarterly prescription performance has steadily increased from KRW 2.3 billion in Q1 2023, nearly doubling in two years. Lorviqua, a third-generation ALK inhibitor, has rapidly expanded its presence due to its excellent ability to control brain metastases and systemic efficacy. Additionally, the expansion of its reimbursement coverage for first-line treatment, starting this year, is also cited as a major factor in its growth. Alunbrig recorded KRW 2.7 billion in outpatient prescription sales in Q2 this year. This is a 22.9% decrease compared to KRW 3.5 billion in the same period last year. Alunbrig initially generated demand by emphasizing its convenience of administration, central nervous system penetration rate, and response rate during its early introduction. However, its competitiveness appears to be weakening recently due to Lorviqua's rapid growth. Xalkori's Q2 prescription sales decreased by 6.6% to KRW 1.4 billion compared to last year. Xalkori, a first-generation ALK inhibitor, has shown a continuous decline in prescriptions since the emergence of subsequent drugs. This is because late entrants have proven superior efficacy and safety compared to Xalkori. Second and third-generation targeted therapies are known to have lower drug toxicity and reduced incidence of adverse reactions compared to first-generation therapies. They are known to demonstrate superior therapeutic efficacy. Additionally, second and third-generation targeted therapies have the advantage of higher CNS penetration, including into the brain.

- Opinion

- [Reporter's View] Gov’t cooperation leads to a price cut?

- by Eo, Yun-Ho Jul 16, 2025 06:10am

- There are times when cooperation ends up causing losses. In an ironic twist, pharmaceutical companies that participated in the government's infertility support program have now found their products caught in the net of the Price-Volume Agreement (PVA) system, leaving them little choice but to face rapid drug price cuts. The government's infertility support program, aimed at addressing the low birthrate issue, has been steadily expanded over the past years. Last year alone, it was expanded 3 times, and in January 2024, the previous eligibility criterion of “household income at or below 180% of the median income” was abolished, and subsidies for in vitro fertilization and artificial insemination were provided regardless of income. In February, the number of reimbursements covered by national health insurance was increased from a maximum of 16 sessions per person for in vitro fertilization (9 times for fresh embryos and 7 for frozen embryos) to a maximum of 20 sessions per person (without distinction between fresh and frozen embryos). In November, the government also expanded the co-insurance rate for infertility treatments, which had previously been differentiated by age (30% for those aged 44 and under and 50% for those aged 45 and over), to a uniform 30% regardless of age. With the expanded infertility support, demand also increased significantly. The supply of infertility treatments could not keep up with demand, leading to supply disruptions and shortages. Follicle-stimulating hormone (FSH) preparations, which are essential for infertility treatment, are used to induce hyperovulation in assisted reproductive technology (ART) such as in vitro fertilization or artificial insemination. The issue is that most follicle-stimulating hormone preparations are hormone preparations (biological drugs) with complex manufacturing processes, making it difficult to increase production to meet the increased demand. From 2023 to the present, companies have reported supply disruptions or shortages for 7 follicle-stimulating hormone preparations to the Ministry of Food and Drug Safety. However, major FSH preparations that had expanded their supply to meet the rising demand have now been selected for PVA (Price-Volume Agreement) negotiations starting this July. The outcome will almost certainly lead to drug price reductions. Demand for infertility treatments is expanding globally beyond domestic markets. China has expanded public health insurance coverage for in vitro fertilization (IVF) in major cities like Beijing and other provinces starting in 2023 as part of efforts to address low birth rates. The United States is also expanding support policies, including the first federal-level executive order in February 2025 to enhance access to IVF, moving beyond previous state-level initiatives. In other words, it is not easy for any pharmaceutical company to ensure a smooth supply of the lacking IVF drugs in line with policy trends. The fact that many pharmaceutical companies are giving up is evidence of this. It is time for the government to provide appropriate compensation for those who cooperate with national healthcare initiatives.

- Company

- What benefit will BeOne Medicines’ Tevimbra bring?

- by Whang, byung-woo Jul 16, 2025 06:10am

- Tevimbra (tislelizumab), the first immune-oncology drug to be reimbursed for the treatment of esophageal cancer, is expanding its indications to penetrate the market. In a market already dominated by established immune-oncology drugs such as Keytruda (pembrolizumab) and Opdivo (nivolumab), pricing and scalability are expected to be key strategic factors. On the 15th, BeOne Medicines Korea held a press conference to highlight the significance of the 5 additional indications it received approval -- esophageal cancer, stomach cancer, and first- and second-line treatment for non-small-cell lung cancer – and the improved treatment access. Tevimbra employs a dual mechanism of action that blocks the binding of PD-1 and PD-L1, effectively inhibiting PD-L1 while minimizing binding to Fc-gamma receptors (FcγR), thereby offering a differentiated mechanism of action compared to existing immunotherapy drugs. Professor Se Hoon Lee, Department of Hematology and Oncology at Samsung Medical Center Tevimbra was approved last November as an immuno-oncology drug with a PD-1 inhibition mechanism that demonstrated clinical efficacy in esophageal squamous cell carcinoma, and in April, it became the first immuno-oncology drug to be reimbursed for esophageal cancer. At the end of June, the drug was approved by the Ministry of Food and Drug Safety for additional indications for esophageal cancer, gastric cancer, and non-small cell lung cancer. Specifically, it has received additional approvals for the treatment of esophageal squamous cell carcinoma (ESCC), gastric or gastroesophageal junction adenocarcinoma (G/GEJ), and non-small cell lung cancer (NSCLC), enabling its use as a first- or second-line treatment for a total of 5 indications across 3 solid tumor types. Tevimbra demonstrated efficacy and safety in the RATIONALE clinical trial series (RATIONALE-303, 304, 305, 306, 307), which served as the basis for its approval. Professor Se Hoon Lee of the Department of Hematology and Oncology at Samsung Medical Center stated, “In the RATIONALE-307 study, the Tevimbra combination therapy group demonstrated efficacy with a 4-year overall survival rate of 32%, an objective response rate (ORR) of 75%, and a progression-free survival (PFS) of up to 9.6 months. This is meaningful data as it showed potential in patients with squamous non-small cell lung cancer (NSCLC), a group in which existing immunotherapies have demonstrated more limited efficacy.” Professor SunYoung Rha, Department of Medical Oncology at Yonsei Cancer Hospital Additionally, Professor Lee explained, “Tevimbra demonstrated long-term survival potential with a median overall survival of over 3 years in patients with non-squamous NSCLC who were EGFR/ALK-negative and had high PD-L1 expression in the RATIONALE-304 study. Notably, the study included patients with stage IIIB disease, expanding the drug’s clinical applicability.” Additionally, Tevimbra demonstrated clinical benefits in the overall patient population with esophageal squamous cell carcinoma and gastric or gastroesophageal junction adenocarcinoma, and consistent results were observed in pre-specified subgroups based on PD-L1 expression. Professor SunYoung Rha of the Department of Medical Oncology at Yonsei Cancer Hospital said, “Tevimbra significantly extended overall survival and reduced the risk of death by 20% regardless of PD-L1 expression. Especially, it demonstrated consistent survival benefits in patients with peritoneal metastasis, making it a meaningful treatment option.” Professor Rha further noted, “Peritoneal metastasis is present in approximately 40% of all gastric cancer patients and is classified as a high-risk group with poor prognosis. However, existing immunotherapy drugs have shown limited efficacy in this patient population, and Tevimbra can be a new hope for these patients.” BeOne Medicines, "Will swiftly proceed with Tevimbra’s drug pricing discussions" With some of Tevimbra’s indications approved and reimbursement granted, competition among treatments is expected to begin in earnest. Ji-Hye Yang, General Manager of BeOne Medicines Korea Although there are already immunotherapy drugs available, the two experts also believe that Tevimbra will play a significant role, given the unmet demand. So what will be Tevimbra’s position in the market? Under the same reimbursement conditions, it is expected that patients with peritoneal metastasis among gastric cancer patients and stage III B patients who are difficult to treat with surgery or radiation with squamous non-small cell lung cancer and non-squamous non-small cell lung cancer will be given priority consideration for using Tevimbra. In particular, there are observations that BeOne Medicines will compete on drug prices to obtain rapid approval, as it will immediately seek reimbursement for the additional indications Tevimbra has been approved for. Ji-Hye Yang, General Manager of BeOne Medicines Korea, said, “While it is difficult to disclose exact figures regarding reimbursement pricing, we are committed to securing coverage faster than any other immunotherapy currently available in Korea. We plan to work closely with the Health Insurance Review and Assessment Service to set an appropriate price so that more patients can benefit clinically."f

- Company

- Paxlovid prescriptions exceed ₩10B in Q2 amid resurge

- by Kim, Jin-Gu Jul 16, 2025 06:09am

- Quarterly prescriptions for the COVID-19 treatment Paxlovid have surpassed KRW 100 billion. Since entering the prescription market in October last year, usage has rapidly increased, with cumulative prescriptions reaching KRW 23.7 billion. This is believed to be due to the resurgence of COVID-19 in South Korea in March and April this year. According to the market research institution UBIST on the 15th, Paxlovid's domestic prescription sales in the second quarter reached KRW 11.4 billion. Paxlovid is an oral antiviral drug that helps inhibit the proliferation of the COVID-19 virus. It is mainly prescribed to high-risk patients who are at risk of developing severe illness. Initially, the government directly purchased and distributed the drug free of charge, but in June last year, the government halted new supplies, shifting distribution to general medical institutions with prescriptions. In October last year, Paxlovid was approved for reimbursement and entered the prescription market in earnest. The insurance price ceiling was set at KRW 941,940, with the patient’s coinsurance rate set at 5%. Patients can now obtain a prescription for the drug at an out-of-pocket cost of around KRW 50,000. After entering the prescription market, Paxlovid has rapidly expanded its prescription sales. Paxlovid's prescription sales, which amounted to KRW 4.1 billion in the fourth quarter of last year, doubled to KRW 8.2 billion in the first quarter of this year in just 3 months. In the second quarter of this year, it increased by 40% to exceed KRW 10 billion. Cumulative prescription sales to date have reached KRW 23.7 billion won. Monthly Paxlovid prescriptions This is analyzed as a result of the resurgence of COVID-19 in the first half of this year. According to the Korea Disease Control and Prevention Agency's weekly COVID-19 report, the number of COVID-19 patients reported by 221 hospitals under sample surveillance remained at an average of 70 throughout the fourth quarter of last year, but surged to 143 in the first week of January this year. After a brief lull, the number began to rise again in March. In the first week of April, the number increased to 185, marking the beginning of a resurgence, which continued through May. The number of severe COVID-19 patients requiring hospitalization, for whom Paxlovid prescriptions are concentrated, also increased significantly after April. During this period, monthly Paxlovid prescription sales also rose sharply. In particular, sales reached KRW 48 billion in April alone. The prescription performance of Paxlovid in the second half of the year is expected to vary depending on the COVID-19 outbreak situation after July. The industry predicts that Paxlovid prescriptions may increase again if COVID-19, influenza, and colds spread simultaneously in the fall, as in previous years. COVID-19 cases in Korea (sample surveillance)